Brazilian authorities have uncovered a $9.7 billion crypto laundering scheme, arresting suspects in multiple cities as part of a major financial crime investigation.

Brazilian authorities have clamped down on a multi-billion-dollar money laundering scheme involving cryptocurrencies across multiple cities, including São Paulo, Fortaleza, and Brasília.

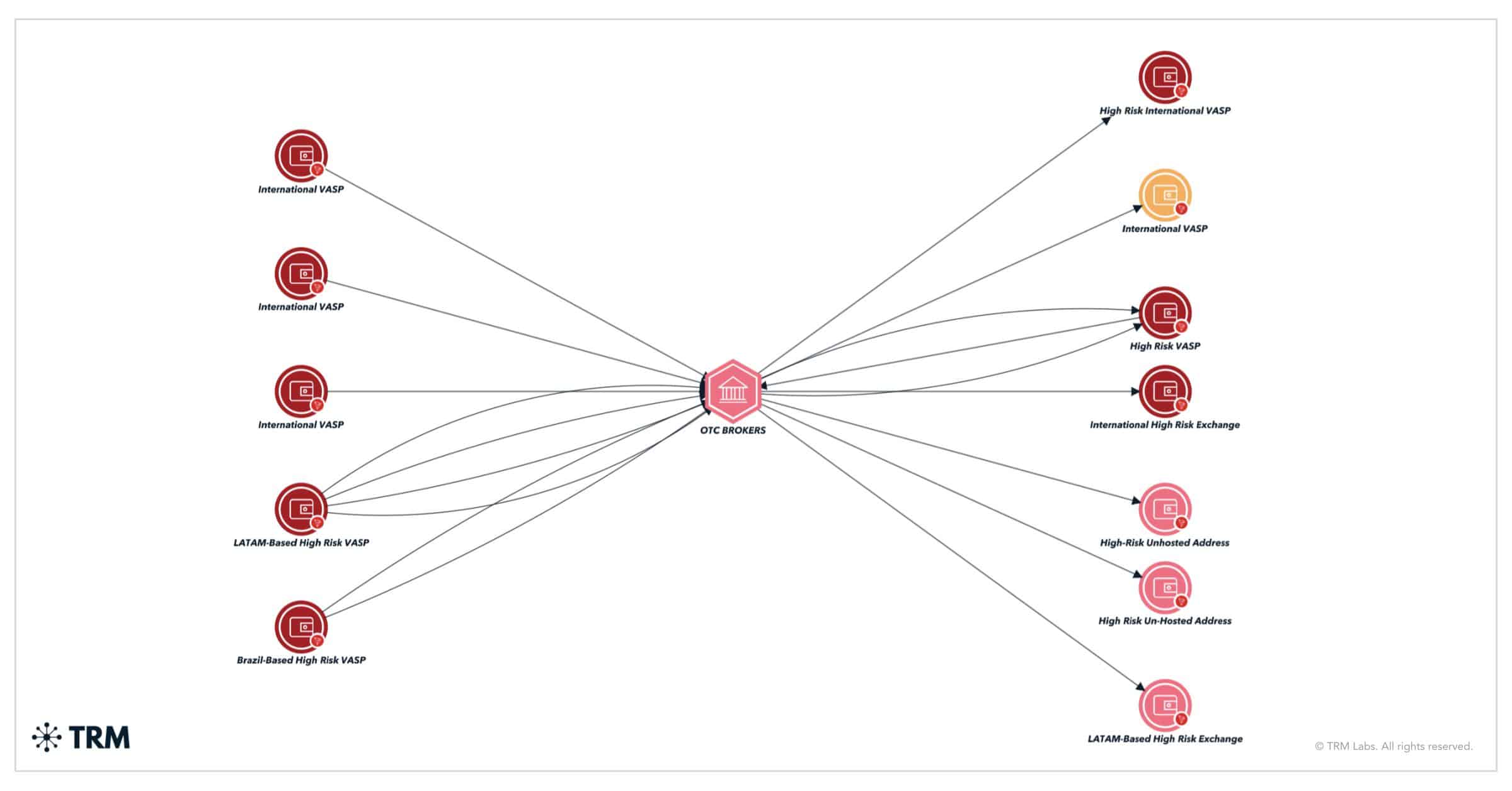

As part of the so-called “Operation Niflheim,” the Federal Revenue and Federal Police executed 23 search and eight arrest warrants, targeting a network suspected of using crypto to launder funds from criminal activities, such as drug trafficking and smuggling, blockchain forensic firm TRM Labs revealed in a Sept. 20 blog post.

The investigation centers on two companies in Caxias do Sul that allegedly moved R$ 19 billion (around $3.6 billion) and R$ 15 billion ($2.8 billion) between August 2019 and May.

The scheme involved four layers, including tax evaders, shell companies, and firms facilitating foreign exchange and crypto transactions. Laundered funds were then transferred abroad to countries like the U.S., Hong Kong, and the UAE.

“Authorities discovered that over half of the deposits linked to the main suspects came from individuals with criminal backgrounds, pointing to widespread use of cryptocurrencies to facilitate illicit activities.”

TRM Labs

A federal court froze $1.58 billion in funds held in bank accounts and cryptocurrency exchanges, though the report did not specify which platforms were involved. In total, the Federal Police reported that over $9.7 billion had been laundered since the investigation began in 2021, underscoring the significant role cryptocurrencies play in facilitating financial crimes in Brazil.

This article first appeared at crypto.news