The eighth-largest meme coin, Book of Meme, witnessed a sharp decline as the broader cryptocurrency market witnessed a bearish storm.

The Book of Meme (BOME), a Solana-based meme coin, fell by over 5.7% in the last 24 hours to $0.00976, marking a 14% drop after reaching a six-week high of $0.0114 at 07:25 UTC on July 31, according to crypto.news data.

Despite the recent downturn, BOME is still the top gainer among the leading 100 cryptocurrencies by market capitalization over the last seven days.

BOME’s price drop brought its market cap down to $680 million, making it the 95th-largest digital asset at the reporting time. The meme coin also witnessed a 24.7% decrease in its daily trading volume, currently hovering at $282 million.

Data indicates that the BOME Relative Strength Index, which measures price momentum, is around 37 on a 100-point scale, suggesting that the meme coin is oversold at the current price level.

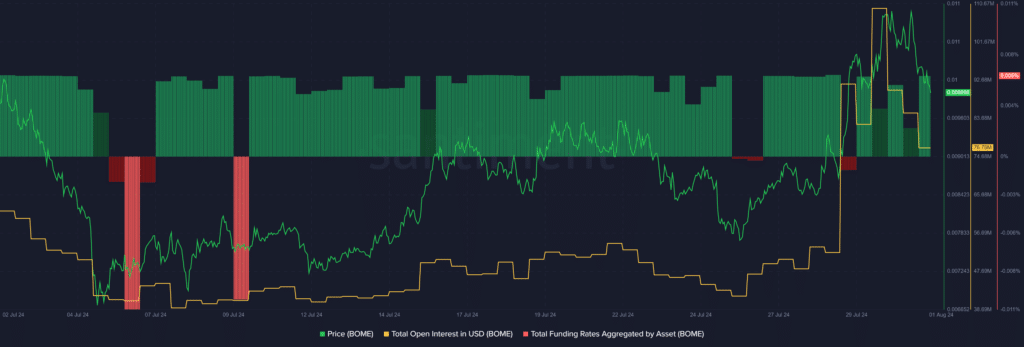

According to data provided by Santiment, BOME’s total open interest plunged from $109.58 million on July 30 to $76.76 million at the reporting time. With the decrease in trading volume and open interest, BOME is expected to experience lower price volatility due to fewer liquidations.

Data from the market intelligence platform shows that the number of trades betting on the meme coin’s price surge has increased again.

Per Santiment, the total funding rate aggregated by BOME dropped from 0.0052% on July 30 to 0.0021% on July 31 and is currently hovering at 0.0059%. The chart shows that traders are bullish on the meme coin despite the 3.1% decline in the global crypto market capitalization.

This article first appeared at crypto.news