Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

__________

Legal news

- The US Securities and Exchange Commission (SEC) said it charged crypto lender BlockFi with failing to register the offers and sales of its retail crypto lending product. In this first-of-its-kind action, the SEC also charged BlockFi with violating the registration provisions of the Investment Company Act of 1940, they added. To settle the charges, BlockFi agreed to pay a USD 50m penalty, cease its unregistered offers and sales of the lending product, BlockFi Interest Accounts (BIAs), and attempt to bring its business within the provisions of the Investment Company Act within 60 days. Moreover, BlockFi agreed to pay an additional USD 50m in fines to 32 states to settle similar charges. Also, BlockFi’s parent company announced that it intends to register under the Securities Act of 1933 the offer and sale of a new lending product. “As we shared earlier, we intend to file or confidentially submit a registration statement to the SEC for BlockFi Yield, a new crypto interest-bearing security,” the company said.

- Former attorney Philip Reichenthal pled guilty in Manhattan, USA federal court to conspiracy to commit wire fraud as part of a scheme worth USD 5m to defraud investors who thought they were investing in bitcoin (BTC). He, along with a number of associates, promised investors they would purchase them BTC but never did so, nor did they refund the money.

Regulation news

- T Rabi Sankar, who took over as the Deputy Governor of the Reserve Bank of India in May, called for an outright ban on cryptoassets, reported CNBCTV18, citing Sankar’s keynote address at Indian Banks’ Association (IBA’s) Annual Banking Technology Conference & Awards on February 14. “We have examined arguments by those advocating cryptos should be regulated and found that none of them stand up to basic scrutiny,” he reportedly said. Crypto can and, if allowed, most likely will “wreck the currency system, the monetary authority, the banking system, and in general the government’s ability to control the economy,” Sankar was quoted as saying.

- The US Treasury Department indicated that it plans to spare crypto miners and stakers from rules that would require digital-asset brokers to turn over information on their clients’ transactions to the Internal Revenue Service (IRS), per Bloomberg. The watchdog stated that the reporting requirements for brokers would not include “ancillary parties who cannot get access to information that is useful to the IRS.”

DeFi news

- Titano Finance is rugged, announced the security and data analytics company PeckShield today. “The owner sets the PrizeStrategy contract, which then drains about [BNB 4,828 (USD 1.94m)],” they said. However, the Titano team denied that, stating that its recently-launched competition Titano PLAY was hacked and that the DeFi company didn’t mint any tokens. They added that they know who the hacker is, and that “[a]nyone involved in Titano PLAY will have their tokens fully returned.”

- Following the DeFi protocol Qubit Finance hack worth USD 80m, Bunny Finance and Mound, both projects that had lost significant amounts of money in the exploit, have announced they will have to downsize their teams. Additionally, they said they will be governed by their decentralized autonomous organization (DAO) instead of the team, meaning that the community will possess all relevant authority such as upgrading contracts, altering fee structure, and so on.

Investments news

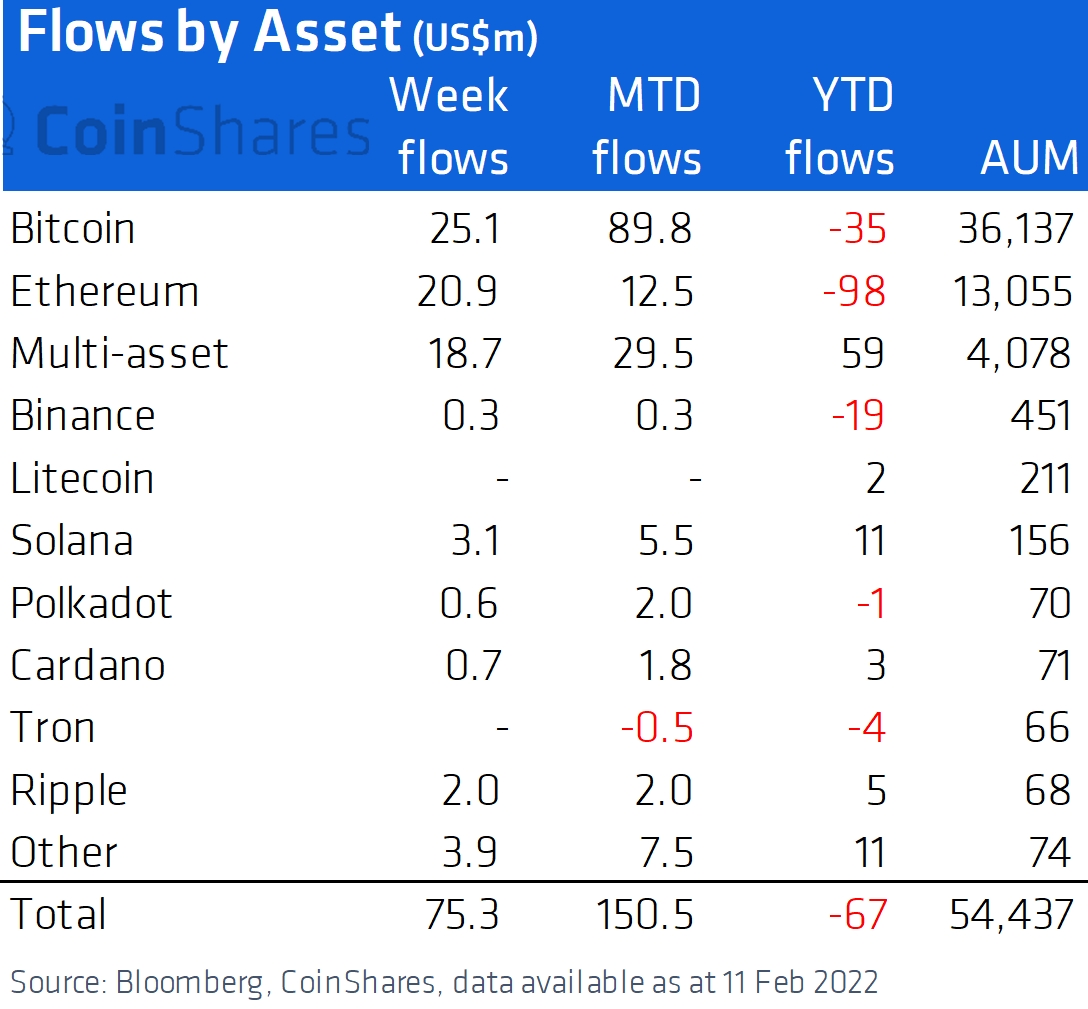

- Digital asset investment products saw inflows totaling USD 75m last week, marking the 4th week of inflows totaling USD 209m, according to CoinShares. Bitcoin still leads the inflows with USD 25m last week (USD 71m a weak earlier), while investment products flows for ethereum (ETH) finally broke its 9-week string of outflows with inflows totaling USD 21m last week (USD 8.5m in outflows a week earlier), per CoinShares.

- Non-fungible token (NFT)-focused company Animoca Brands partnered with global venture accelerator Brinc to launch the Guild Accelerator Program to build and grow the play-to-earn (P2E) guild ecosystem globally. The new acceleration program offers a total investment capital of up to USD 30m over two years.

- Singapore’s state investment fund and one of the world’s largest investors Temasek sold its position in crypto exchange Coinbase (COIN), according to its filings with the SEC. In its Q3 filing, the fund listed ownership of 8,168 Coinbase shares worth some USD 2.1m, while its Q4 filing does not show any Coinbase holdings.

Mining news

- Bitcoin mining hashrate (computational power) hit a new all-time high on February 13 of 229.45 E, jumping from 191.9 E seen two days prior, per BitInfoCharts. 7-day simple moving average also recorded a new all-time high on the same day, hitting 200.73 E.

Crime news

- Roughly 74% of ransomware revenue in 2021, or over USD 400m worth of crypto, “went to strains we can say are highly likely to be affiliated with Russia in some way,” said blockchain analysis company Chainalysis. Blockchain analysis combined with web traffic data suggest that after ransomware attacks take place, most of the extorted funds are laundered through services primarily catering to Russian users, they added.

Exchanges news

- FTX.US has begun accepting users for a waitlist to learn about its soon-to-be-launched stock trading platform. They had previously stated they would include stocks in their offering, along with teasing some of the features they would offer.

Entertainment news

- Streaming giant Netflix ordered a documentary series about Ilya “Dutch” Lichtenstein’s and Heather Morgan’s alleged scheme to launder billions of dollars worth of stolen crypto in the Bitfinex hack. Chris Smith is set to direct and executive produce along with executive producer Nick Bilton.

NFTs news

- Real estate startup Propy sold its first NFT-backed property in the US, where a 2,164-square-foot house in Florida, USA, fetched USD 653,000 (ETH 210) at an auction. The new owner was awarded an NFT as proof of the home’s ownership.

- NFT marketplace OpenSea announced two new community investment programs, Ecosystem Grants and OpenSea Ventures. OpenSea Ventures is a new investment arm supporting those building open Web 3 economies, while Ecosystem Grants is aimed at elevating creators, developers, and community members working to “enrich and expand the NFT ecosystem”, they added.

This article first appeared at Cryptonews