Key Takeaways

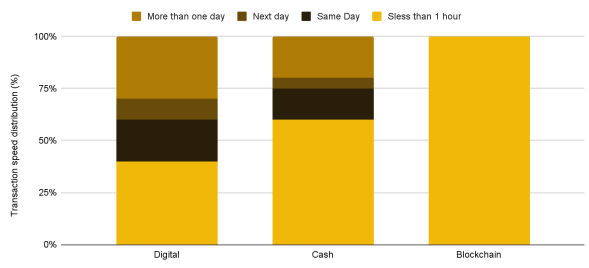

- Blockchain-based remittances settle within an hour, outperforming traditional methods.

- Solana processes about 1,000 TPS, while Visa has a capacity of over 65,000 TPS.

Share this article

Blockchain technology is revolutionizing the payments industry with near-instantaneous settlement times and significantly lower costs compared to traditional systems.

According to a recent report by Binance Research, blockchain-based remittances settle within an hour, outpacing both digital and cash methods.

Visa’s pilot with Crypto.com using USD Coin (USDC) on the Ethereum blockchain has streamlined cross-border settlements for their Australian card program, reducing complexity and time.

While conventional card networks like Visa and Mastercard offer quick authorization, actual fund transfers can take days, especially for cross-border transactions.

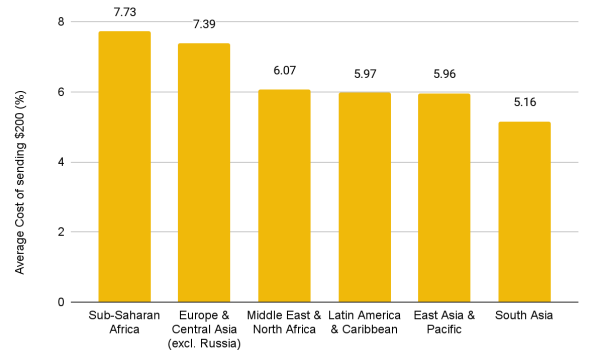

Moreover, the cost benefits are highlighted in the report as substantial. Traditional remittance costs average 6.35% globally, while blockchain transfers on networks like Solana cost as little as $0.00025, regardless of the amount sent. Binance Pay offers free transfers up to 140,000 USD Tether (USDT), with a $1 fee for larger amounts.

Blockchain’s transparency and decentralization are also underscored in the report as advantages, such as the fact that every transaction is recorded on an immutable ledger, fostering trust and accountability, while the decentralized nature enhances security and resilience against attacks.

Challenges faced by blockchain payments

Despite the benefits identified in the report, challenges remain. Current blockchain networks lag behind traditional systems in transaction processing capacity.

Solana, the fastest layer-1 blockchain, processes about 1,000 transactions per second (TPS), compared to Visa’s capacity of over 65,000 TPS. Network stability is also a concern, as Solana experienced seven major outages since 2020.

Furthermore, the complexity of transitioning from legacy payment rails to blockchain infrastructures can present complexities that are inconvenient for consumers and merchants.

“Requirements placed on the end users such as seed phrase management, paying for gas fees, and lack of unified front-ends make the adoption of blockchain technology a major pain for the average consumer and merchant,” the report pointed out.

Lastly, crypto and blockchain are topics that are still located in grey zones in various jurisdictions. Additionally, the regulations drawn by regions can vary significantly, which increases the complexity of a global payment network based on blockchain.

This regulatory uncertainty then presents another challenge to blockchain implementation in the payments sector.

Despite these issues, institutional adoption is growing. Visa has described Solana as viable for testing payment use cases, and PayPal launched its PYUSD stablecoin on the network. As blockchain technology matures and regulatory frameworks evolve, it has the potential to create a more efficient, accessible global payment system.

Share this article

This article first appeared at Crypto Briefing