Share this article

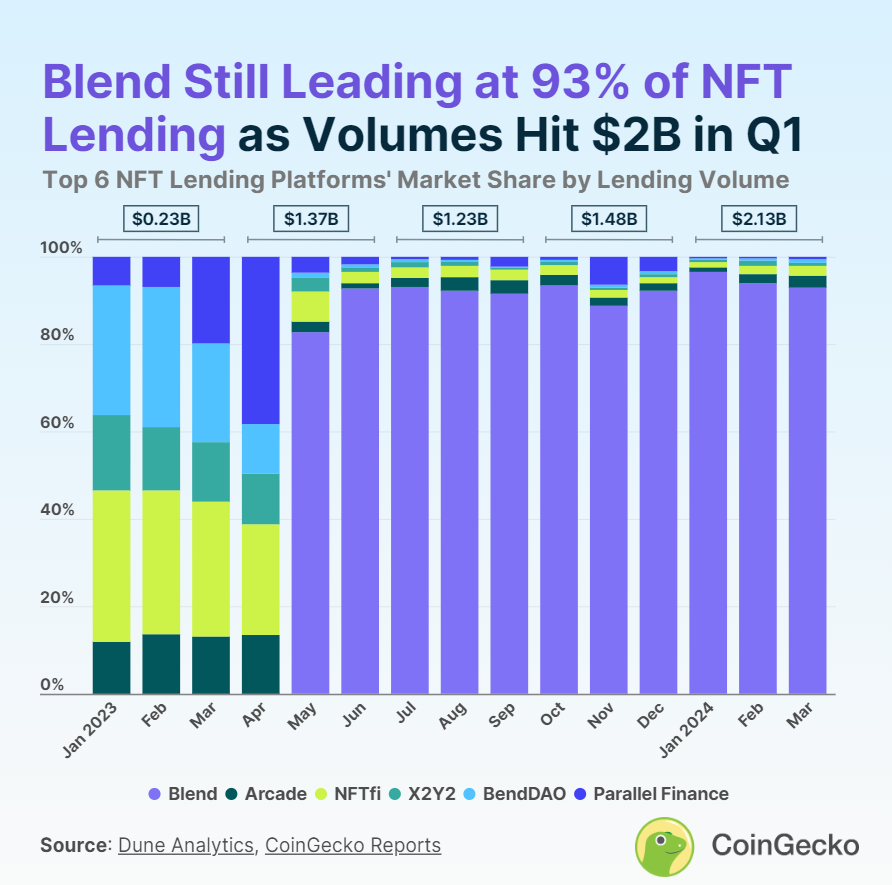

The lending market based on non-fungible tokens (NFT) as collateral surpassed $2 billion in volume during the first quarter, sustaining growth of 44% compared to Q4 2023, according to a CoinGecko report.

“Crypto markets are all about market rotation […] There’s clearly a trend where OG NFT holders are leveraging these [lending] platforms to get liquidity and take advantage of the positive sentiment of the market with meme coins and other stuff,” explains NFT Price Floor analyst Nicolás Lallement.

He mentions as an example the move made by SquiggleDAO, which used some of its Chrome Squiggles holdings as collateral to get a $1 million loan through Zharta Finance, using the money to invest in other assets. However, once investors are done with profits with the current narratives, Lallement foresees the money flowing into Bitcoin, Ethereum, and blue chip NFTs, including new collections created on Bitcoin infrastructures.

Blend shows strong domination

Lending platform Blend showed significant dominance in the market, achieving nearly 93% of the market share with $562.3 million in monthly lending volume as of March 2024.

Since its inception in May 2023 by the leading NFT marketplace Blur, Blend has rapidly ascended to market dominance, initially seizing an 82.7% share. Consistently leading the market, Blend’s share has fluctuated between 88.8% and 96.5%. The first quarter of 2024 marked a 49.2% quarter-on-quarter (QoQ) increase in Blend’s NFT lending volume, totaling over $2.02 billion.

While Blend leads the pack, Arcade and NFTfi trail as notable smaller players in the NFT lending space. Arcade holds a 2.8% market share with a $16.9 million lending volume, and NFTfi follows closely with a 2.2% share from a $13.3 million volume in March 2024. Both platforms have maintained over 1% in monthly market share since the previous year.

Arcade’s NFT lending volume hit a new quarterly record of $39.4 million in Q1 2024, up 37.1% QoQ. NFTfi also saw a significant rise of 48.3% QoQ, reaching a lending volume of $35.8 million. With Arcade’s recent token launch and NFTfi’s anticipated token release, the industry is watching closely to gauge the potential impact on their respective lending volumes.

Other NFT lending platforms, such as X2Y2 (X2Y2) and BendDAO (BEND), each hold a 0.8% market share, while Parallel Finance (formerly ParaX) accounts for 0.5% of the market.

January 2024 alone saw a record-breaking $900 million in total monthly NFT lending volume, surpassing the previous peak of $850 million in June 2023.

As Ethereum NFT collections continue to be the primary collateral for loans due to the synergy between Blend and Blur, the burgeoning popularity of Bitcoin Ordinals introduces a new variable to the NFT lending market’s future trajectory.

Share this article

This article first appeared at Crypto Briefing