Key Takeaways

- BlackRock’s Bitcoin and Ethereum ETFs experienced a huge influx of $158 million in one day.

- Global monetary policies, including US rate cuts and China’s stimulus, boost crypto market confidence.

Share this article

BlackRock’s spot Bitcoin and Ethereum exchange-traded funds, the iShares Bitcoin Trust (IBIT) and Ethereum Trust (ETHA) collectively drew in around $158 million in net inflows on Tuesday amid a crypto market recovery that saw Bitcoin surge past $64,000.

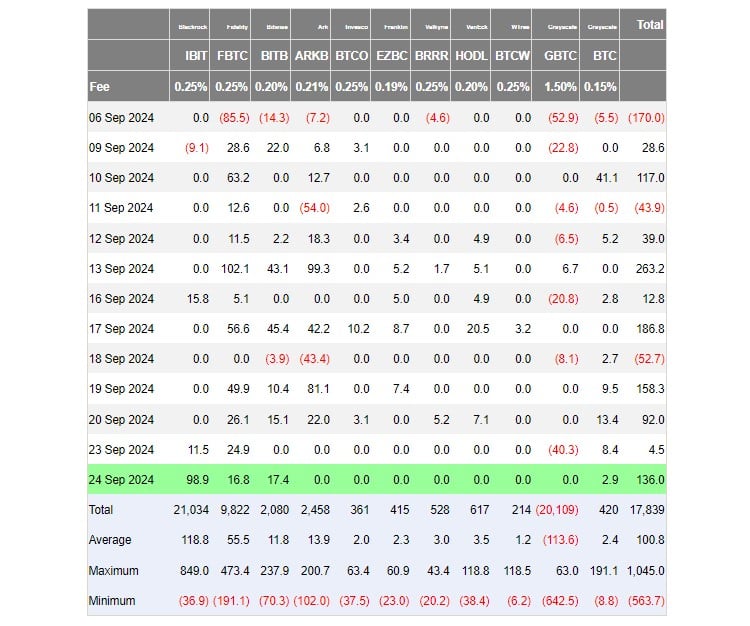

According to data tracked by Farside Investors, the IBIT fund logged approximately $99 million in new capital, bringing its total net buying since launch to $21 billion.

IBIT made a strong performance after a period of stagnation with minimal inflow days reported, several days of no flows, and some bleeding days. Tuesday’s gain marked IBIT’s largest single-day inflow since August 23.

Competing funds managed by Fidelity and Bitwise also posted gains of around $17 million each on Tuesday while Grayscale’s Bitcoin Mini Trust took in nearly $3 million in net inflows. No flows were reported from other ETFs.

With IBIT’s massive inflows and additional capital into other funds, the US spot Bitcoin ETFs ended the day with roughly $136 million in net capital, extending their winning streak to four consecutive days.

Meanwhile, the Ethereum ETF market saw a turnaround after investors withdrew over $79 million from US spot Ethereum funds on Monday. Spot Ethereum ETFs collectively attracted $62.5 million on Tuesday.

Flows turned positive as BlackRock’s ETHA reeled in over $59 million. VanEck’s Ethereum ETF logged nearly $2 million and Invesco’s Ethereum fund saw over $1 million yesterday.

Bitcoin surges past $64,000 amid global monetary easing

The crypto ETF’s positive performance came amid Bitcoin’s price surge. Bitcoin hit a high of $64,700 on Tuesday night before settling at around $64,200, per TradingView.

The uptick is closely tied to the easing of monetary policies by major global economies.

Last week, the US Federal Reserve (Fed) made an aggressive interest rate cut by 50 basis points. Hopeful investors now see a further rate cut by the end of the year, with probabilities rising to 61% for a 50 basis point reduction in November.

Apart from the Fed’s adjustments in monetary policy, China’s monetary stimulus package, which came on Tuesday, is also seen as a positive catalyst for the crypto market.

China’s recent policy adjustments contributed to a brief surge in Bitcoin’s value, although the impact was modest compared to broader market movements.

Bitcoin is now targeting the $65,000 mark, a peak not seen since early August. Analysts suggest that surpassing this threshold is crucial for confirming a bullish trend.

Share this article

This article first appeared at Crypto Briefing