Key Takeaways

- BlackRock data shows Bitcoin allocations in portfolios can significantly outperform traditional investments.

- Bitcoin’s role as a hedge against fiat currency decline is emphasized by BlackRock.

Share this article

At the Digital Assets Conference held today, BlackRock unveiled its latest insights on Bitcoin’s volatility and future performance, stating that Bitcoin’s volatility has significantly decreased and will continue to do so over time.

BREAKING: BITCOINS VOLATILITY HAS DECLINED AND WILL CONTINUE TO FALL – BLACKROCK pic.twitter.com/iCWafcyLyD

— marty (@thinkingvols) October 3, 2024

BlackRock, the world’s largest asset manager, emphasized Bitcoin’s evolving role in the global financial ecosystem. According to BlackRock, Bitcoin’s volatility has been declining steadily, a trend that the firm expects to continue as adoption grows and the asset matures.

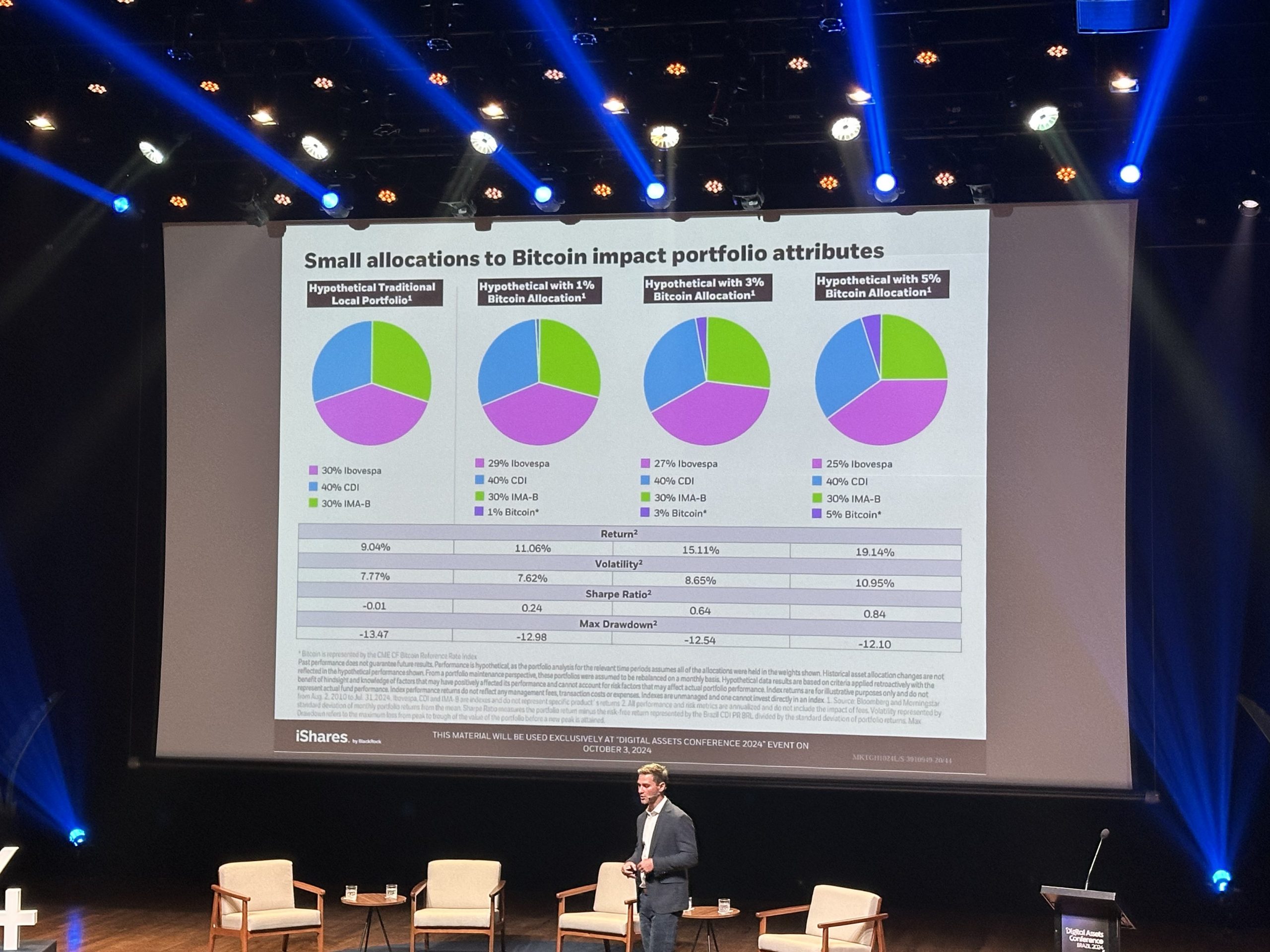

BlackRock’s data showed that adding Bitcoin to portfolios improved risk-adjusted returns across multiple time horizons. Portfolios with a 1%, 3%, or 5% Bitcoin allocation saw higher returns over one, two, five, and ten-year periods compared to traditional portfolios.

While Bitcoin slightly increased volatility in these hypothetical portfolios, the potential for higher returns often outweighed the added risk. For example, portfolios with a 5% Bitcoin allocation achieved a 19.1% return over the long term, significantly outperforming the 11% return from traditional portfolios without Bitcoin exposure.

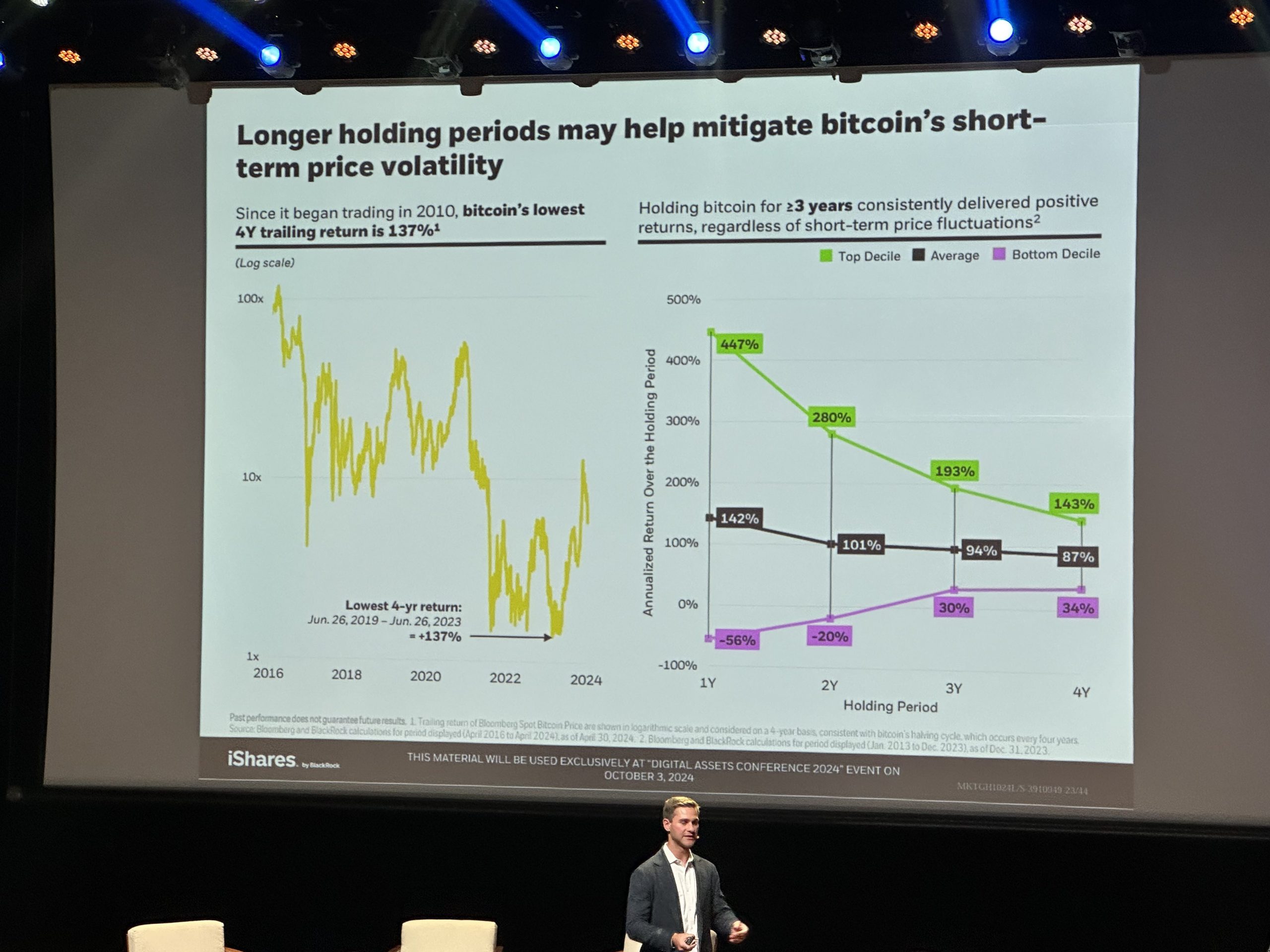

BlackRock’s analysis also emphasized the importance of long-term holding when it comes to Bitcoin’s volatility. According to the firm, Bitcoin’s lowest four-year trailing return is still an impressive 137%, and holding the asset for three or more years has consistently delivered positive returns.

Additionally, BlackRock compared Bitcoin to gold and US Treasuries, emphasizing its fixed supply, decentralized governance, and low correlation with traditional assets, positioning it as a hedge against declining trust in governments and fiat currencies.

Moreover, BlackRock noted that while Bitcoin’s volatility remains elevated, it has declined as the asset matured. The analysis showed Bitcoin’s low correlation with gold (0.1) and the S&P 500 (0.2), highlighting its role as an independent asset class.

Lastly, BlackRock emphasized Bitcoin as a hedge against the declining value of fiat currencies, especially the US dollar. Highlighting the dollar’s drop since 1913, they positioned Bitcoin as a safeguard against inflation. By offering Bitcoin ETFs, BlackRock signals its trust in Bitcoin’s long-term value and growing role in financial markets.

Share this article

This article first appeared at Crypto Briefing