Key Takeaways

- Bitcoin has risen by nearly 13% over the past week.

- A spike in network growth and open interest point to further gains.

- Breaching the $42,100 resistance level would validate the optimistic outlook.

Share this article

Several on-chain metrics suggest that Bitcoin is gaining strength for a significant bullish impulse. Still, the top crypto has a big hurdle to overcome first.

Bitcoin On-Chain Metrics Pick Up

Bitcoin looks like it’s gaining strength again.

The leading cryptocurrency has enjoyed an impressive uptrend over the past week. It’s gained nearly 5,000 points in market value, rising from a low of $37,600 on Mar. 14 to a high of $42,400 on Mar. 19.

Although prices have retraced by roughly 5% in the last 48 hours, Bitcoin’s uptrend appears to be gaining strength.

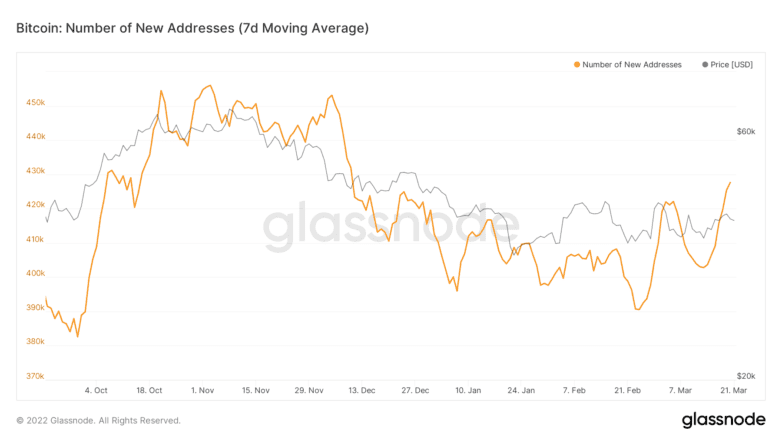

The number of new addresses joining the Bitcoin network has significantly increased since Feb. 21, making a series of higher highs and higher lows. The uptrend in this on-chain metric suggests growing interest from sidelined investors who appear to be re-entering the market.

More than 480,000 Bitcoin addresses were created in Mar. 17 alone, which is a strong positive signal for further upward price action.

Network growth is often considered one of the most accurate price predictors for cryptocurrencies. A steady uptrend in the number of new addresses created on a given blockchain often leads to rising prices over time.

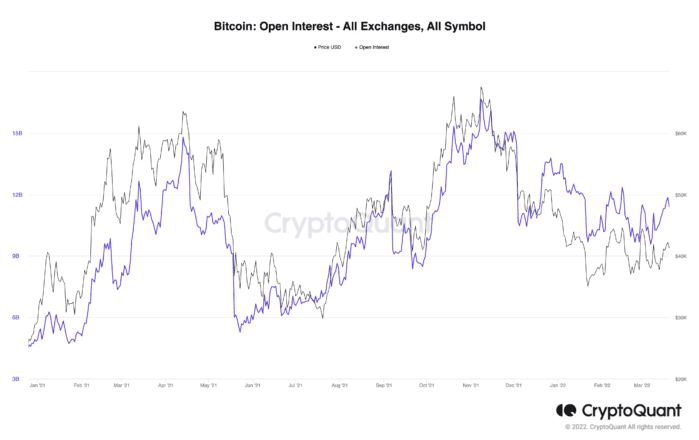

A similar uptrend can be seen in the futures markets, where the number of open positions, including both long and short positions, has been steadily rising since Mar. 7. As open interest increases, it indicates more liquidity, volatility, and attention is coming into the derivatives markets. A continuous increase in open interest to surpass 12.36 million could support Bitcoin’s recent price increase.

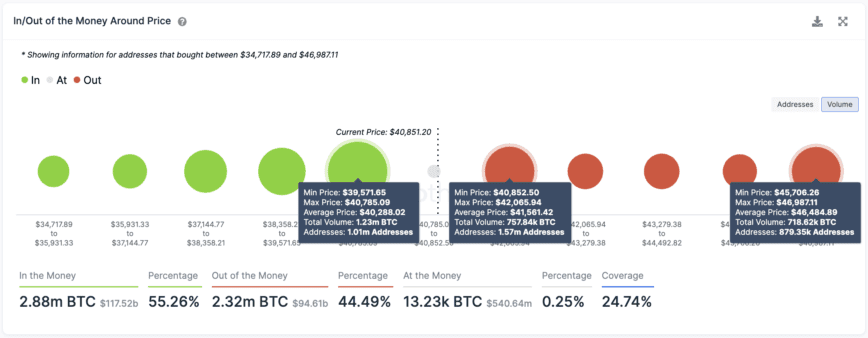

Still, transaction history shows that Bitcoin has one substantial resistance wall to break to be able to advance further.

IntoTheBlock’s In/Out of the Money Around Price model reveals that 1.57 million addresses have previously purchased nearly 760,000 BTC between $40,900 and $42,100. A decisive daily candlestick close above this hurdle could give Bitcoin the strength to break the next critical barrier, which is sitting at $46,500.

The IOMAP also shows that the top-ranked cryptocurrency is holding above stable support as over 1 million addresses have previously purchased 1.23 million BTC at an average price of $40,300. As long as Bitcoin remains trading above this foothold, it has a chance at advancing further. However, failing to do so could result in a downswing to $37,500.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

This article first appeared at Crypto Briefing