Bitcoin hit a new all-time high in anticipation of Trump’s inauguration and prioritization of crypto, however the event disappointed many traders. BTC has since corrected to $105,000 on Tuesday. US-based crypto assets could face volatility in the weeks ahead if the Bitcoin strategic reserve and other promises made pre-election are left unfulfilled.

Table of Contents

Bitcoin missing from the agenda on Trump’s first day

President Donald Trump assumed the oval office on January 20, post his inauguration event. While crypto market had pinned their hopes on an executive order or declaration of crypto as a national “priority” on the first day the crypto President takes office, it was a disappointing day for pro-crypto audiences.

Bitcoin (BTC) retreated from its all-time high above $109,000 and settled close to $105,000 on Tuesday. Top altcoins ranked by market capitalization, Ethereum (ETH) and XRP (XRP), wiped out their recent gains alongside Bitcoin.

President Trump signed over 80 executive orders on their first day back in office while Bitcoin was missing from action. The crypto President promised a Bitcoin strategic reserve and pro-crypto policy and regulation, responding to campaign donations from Political action committees powered by crypto firms and protocols in the US.

It remains to be seen whether a Bitcoin strategic reserve will materialize in the US, or take priority over a slew of other changes to the world’s largest economy.

The crypto market observed $816 million in liquidations as Trump missed Bitcoin and pro-crypto action on day one in office. Farside Investors data shows institutional investors grew increasingly optimistic about Bitcoin in the last few days of the week, as markets remained close on Monday, traders should keep their eyes peeled on inflows to U.S. based Spot Bitcoin ETFs on January 21, Tuesday.

President Trump’s crypto-friendly appointments to key positions like the Treasury and Securities and Exchange Commission (SEC) could help support the sector overall, helping market capitalization hold steady above $3.75 trillion.

Top 5 tokens trending in the U.S.

While crypto markets wait for Trump to nudge the industry towards clearer policy and regulation soon after his inauguration, the top three tokens trending in the U.S. are Official Trump (TRUMP), Melania Meme (MELANIA) and Department of Government Efficiency (DOGE). Bitcoin ranks fifth in popularity and 24-hour trade volume, as recorded by CoinGecko.

Even as Official Trump (TRUMP) and MELANIA (MELANIA) slipped lower post the inauguration event, on-chain intelligence trackers have identified large wallet investors buying the dip in the two meme tokens. This indicates the buyers expect a recovery in the tokens.

Analysts at The Block identified a token that gained from the rising popularity of the meme tokens and noted that the TRUMP memecoin launched on Jan 17, climbing to a $75 billion fully dilated valuation within 48 hours. This marks a 10,000 times price surge in TRUMP.

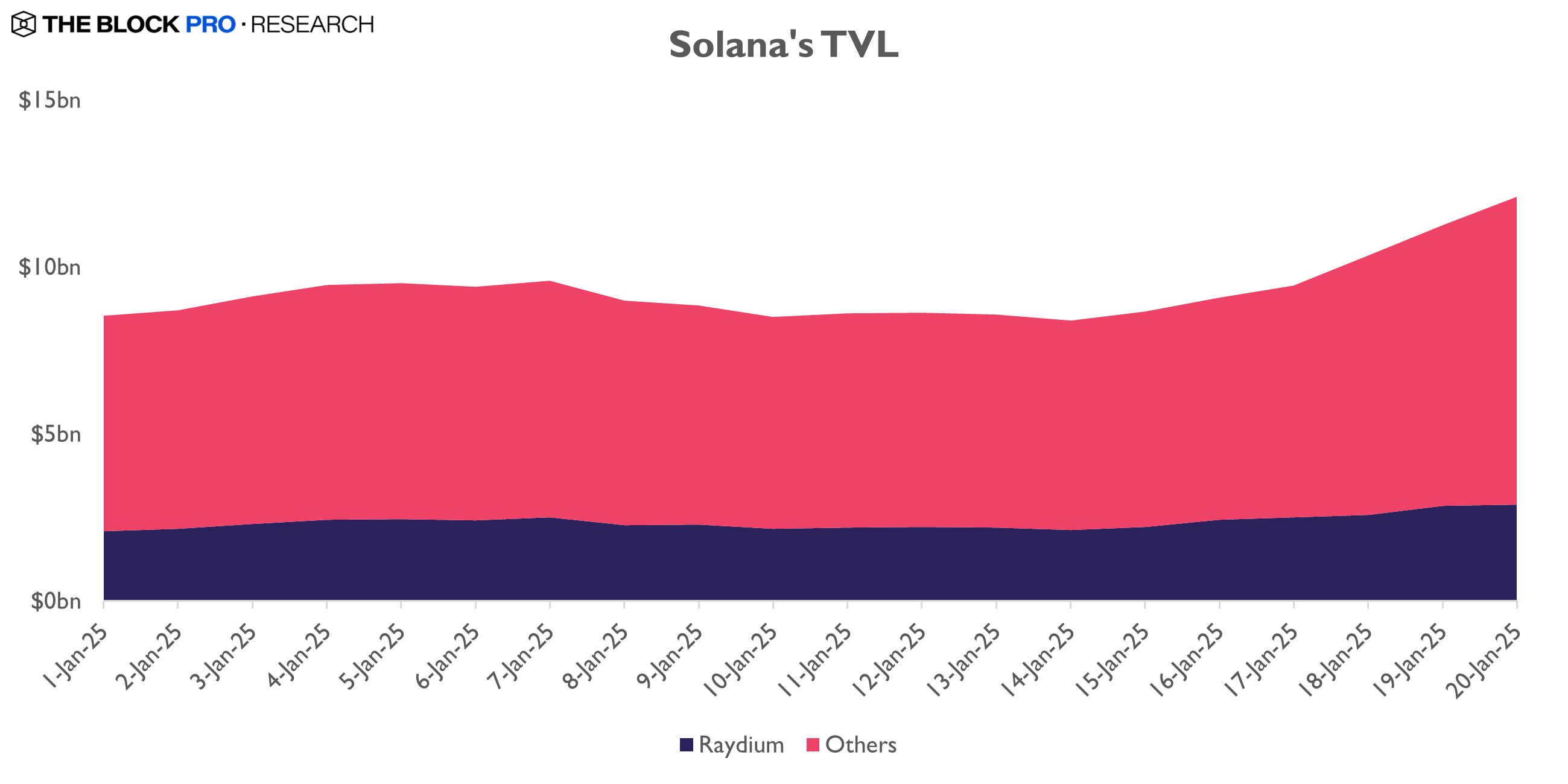

MELANIA memecoin launch on Jan 19 while TRUMP price dropped nearly 50%. Following the two meme token launches, Solana’s (SOL) the total value of assets locked jumped to $3.5 billion, over a 41% increase in TVL within 48 hours.

While SOL ranks fourth in popularity in the U.S., the token continues to gain from meme coin launches and consecutive increase in user activity on its blockchain.

What to expect from Solana, Bitcoin and XRP

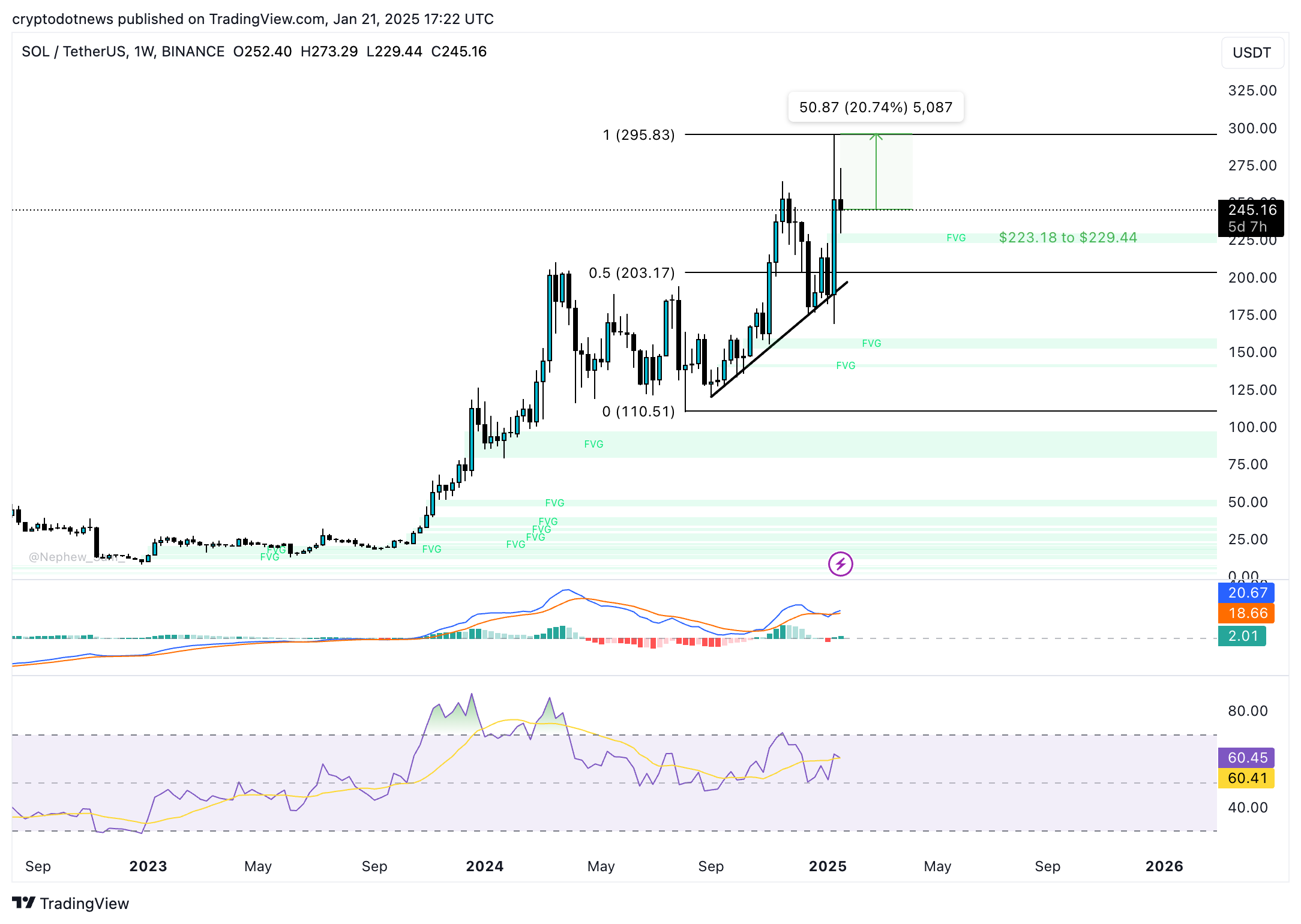

Solana’s weekly price chart shows signs of further gains in the token. SOL is 20% away from its peak of $295.83. The closest support zone is the Fair value gap between $223.18 and $229.44. The Relative strength index reads 60, below the overvalued level at 70 and the moving average convergence divergence indicator flashes green histogram bars above the neutral line.

MACD indicates underlying positive momentum in SOL price trend on the weekly timeframe.

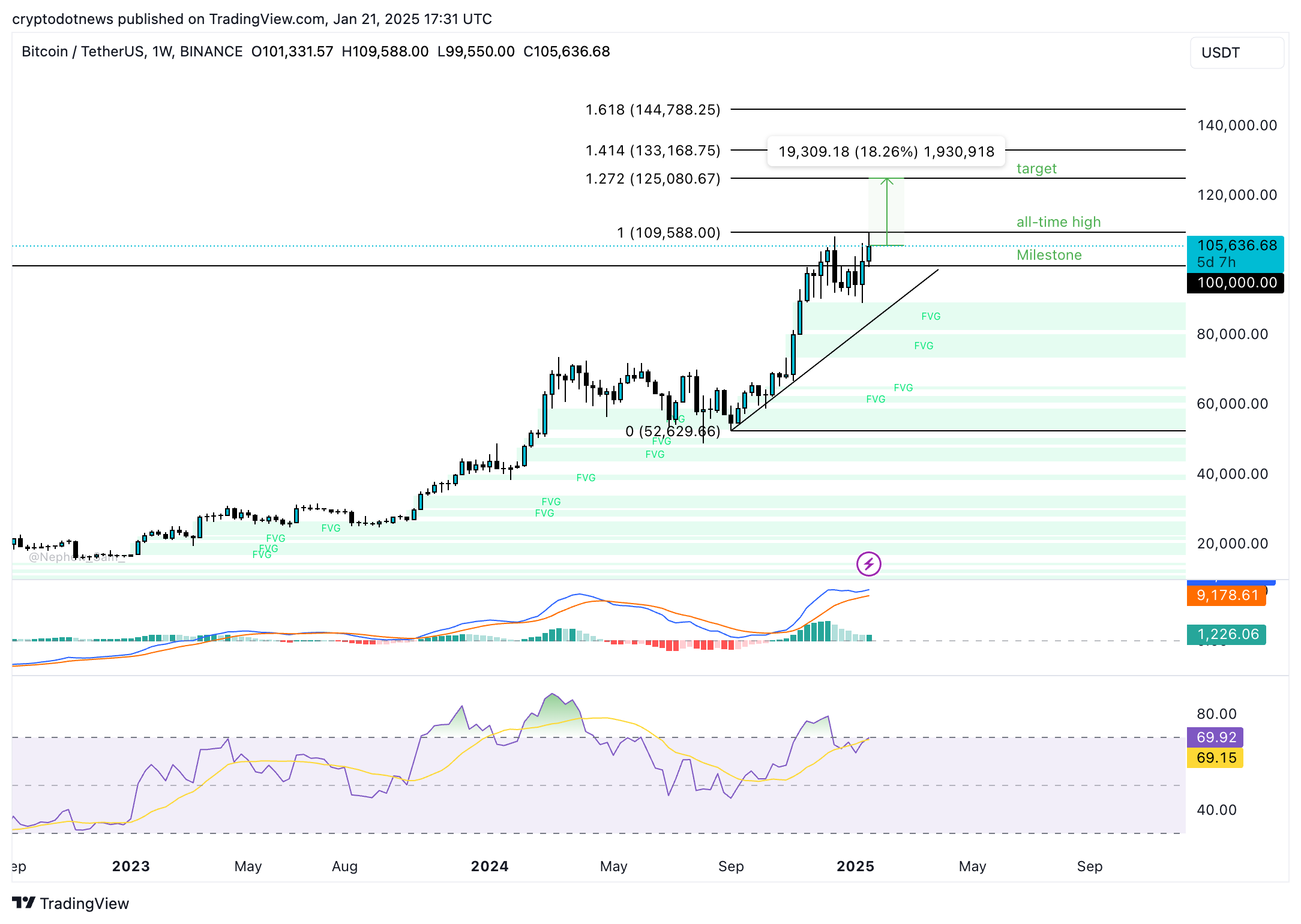

The outlook for Bitcoin and XRP remains positive. Bitcoin hovers close to its all-time high of $109,000 and the largest cryptocurrency could target the 127.2% Fibonacci retracement level at $125,080. This marks over 18% gain in BTC price.

The RSI and MACD, two key momentum indicators, support a bullish thesis for Bitcoin. RSI reads 69 and is sloping upwards.

XRP could rally another 25% and extend its gains to enter price discovery at $3.9815, the 141.40% Fibonacci retracement level of the rally to the altcoin’s all-time high. Both RSI and MACD support a bullish thesis for the altcoin.

RSI shows XRP is currently overvalued, however MACD shows positive underlying momentum. Traders should watch MACD for signs of a trend reversal and XRP could find support at $2.6977, the 50% Fibonacci retracement level of the rally to $3.4000.

Experts optimistic on Trump’s effect on crypto

David Morrison, Senior Market Analyst at Trade Nation, told Crypto.news in an exclusive interview:

“There was widespread disappointment across the crypto sector as the new President made no mention of either a US crypto reserve, or of deregulation. Bitcoin had soared to a record high early yesterday morning on the expectation of some sort of support from President Trump, and following the release of the $TRUMP token on Friday night.

But traders quickly bailed out of their speculative longs as Mr Trump declined to comment. Yet actions speak louder than words. President Trump’s exceedingly crypto-friendly appointments at the Treasury and Securities and Exchange Commission (SEC) should help support the sector overall.”

Morrison remains optimistic on gains in crypto during the Trump administration.

James Toledano, COO of Unity Wallet, notes that over $816 million in long positions and $307 million in shorts were liquidated, indicating a high-risk environment where traders were over-leveraged on both bullish and bearish bets in a very frothy market.

The liquidations have stemmed not only from excessive market leverage and speculative positioning leading up to the inauguration but also from Trump’s omission of Bitcoin in his speech at the event.

Toledano told Crypto.news that:

“While Polymarket estimates a 56% chance of an executive order within Trump’s first 100 days, meaningful crypto policy changes take time and require coordination with the Federal Reserve and regulatory bodies.

Price surges around major political events are often rooted in speculative narratives and wishful thinking rather than concrete policy shifts. The market’s volatility underscores a need for tempered expectations and a focus on long-term fundamentals over speculative milestones.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This article first appeared at crypto.news