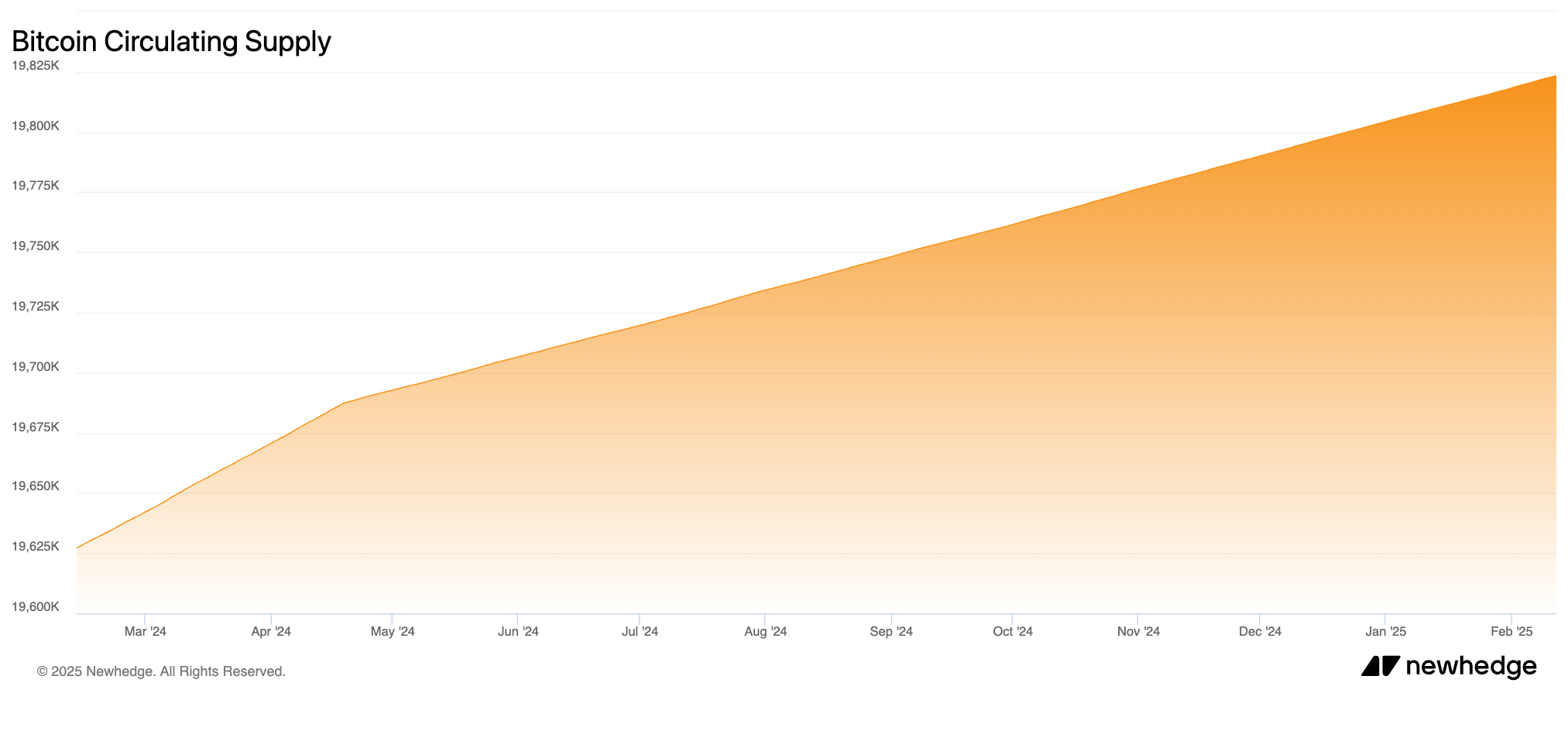

Bitcoin mined has crossed the 19.96 million mark, meaning over 95% of Bitcoin in existence has been issued. The largest cryptocurrency could soon experience a scarcity amidst fast-paced BTC withdrawals from exchanges. U.S. President Donald Trump’s plan for a strategic Bitcoin reserve and developments like institutional adoption and Layer 2 rollout on BTC could catalyze demand for the digital asset.

Table of Contents

Bitcoin scarcity and BTC demand drivers

Bitcoin supply on exchanges decreased by nearly 15% since the declaration of the U.S. Presidential election results in November 2024. In the same timeframe, supply outside of exchanges has climbed from 17.99 million to 18.3 million, according to Santiment data.

Typically, a decline in supply on exchanges and an increase in BTC tokens held by wallets outside of exchanges is considered a bullish sign for the digital asset. The volume of BTC held on exchanges has hit its lowest level in nearly three and half years.

A drop in exchange supply eases selling pressure, and consistent demand historically drives prices higher.

Matthew Sigel, Head of digital assets research at asset management giant VanEck analyzed 20 state-level Bitcoin reserve bills. Sigel predicts that if the bills are enacted, Bitcoin traders could expect $23 billion in demand for BTC. At current prices, the equivalent of 247,000 BTC demand could emerge from institutional investors.

The sum ascertained by Sigel is independent of pension fund allocations, likely to rise if legislators move forward.

Data from Bitbo.io shows that only 1.039 million BTC (BTC) tokens are left to be mined. Over 95% of mined Bitcoin is either in circulation or held in wallets outside of exchanges, held by large wallet investors and entities. Demand from institutional investors could emerge as a top driver for Bitcoin price in 2025.

U.S. Strategic Bitcoin Reserve progress and Trump’s plan for Bitcoin

U.S. President Donald Trump has suggested the creation of a Strategic Bitcoin Reserve, considered a game changing development in crypto. Typically, a reserve asset can be used in times of crisis, nation states maintain Gold reserves and reserves of Oil and Gas to tackle supply shocks.

The proposal to hold Bitcoin as a reserve asset, therefore, solidifies demand for the token from the U.S. The administration currently holds almost 200,000 Bitcoins, seized through criminal investigations conducted by the FBI.

According to a Financial Times report published on February 12, the government has previously sold its BTC holdings, however it is less likely in the Trump administration as the idea of a Bitcoin reserve is discussed.

The finite supply of Bitcoin has garnered advocates who believe that “scarcity adds value” and that holding BTC tokens in reserve would appreciate in value in the long term.

As President Trump supports Bitcoin and digital assets in his pro-crypto stance and campaign, institutional investors and Wall Street Bankers are examining the feasibility of adding the asset to their balance sheet. Trump’s Crypto and AI Tsar, David Sacks said, “One of the first things we’re going to look at is the feasibility of a bitcoin reserve.”

Bitcoin Layer 2 protocols

Kevin Liu, founder and CEO of GOAT Network discussed technological advancements on the Bitcoin blockchain and commented on the feasibility and future of Bitcoin Layer 2 protocols in an exclusive interview with Crypto.news.

Liu said:

“It only makes sense to offer numerous ways for that growing number of users to engage (with Bitcoin). Most Bitcoin Layer 2 networks rely on Bitcoin to fuel their economies, whereas most Ethereum Layer 2 lean on Ether. Different options for different users.

I do think Bitcoin L2s are well positioned, because Bitcoin is the undisputed king of cryptocurrencies, by market cap, mindshare, and pretty much any other major metric. Since Bitcoin L2s are such a new concept, there’s also a lot more room for growth and novel use cases than the more mature Ethereum L2 and alt-L1 markets.”

Liu told Crypto.news that numerous large institutions are rolling up their sleeves to learn more about Bitcoin Layer 2 networks and BTCFi.

“Both institutions and individual users don’t want to sell their Bitcoin. They want to put it to work, earning real BTC yield. They can then use that yield to, say, pay for capital gains, or just everyday expenses. If the BTC yield is large enough, there may even be room to pay for day-to-day requirements and grow their overall stack.”

When asked about the altcoin season and Bitcoin dominance this market cycle, Liu said,

“Every bull market has seen Bitcoin dominance spike dramatically at some point, sucking the life and liquidity out of most other altcoins. That’s what’s happened for most of this cycle too. How altcoins perform from here will answer your question regarding how the overall market performs.

What we can say is that BTCFi is a new and exciting opportunity for crypto users, and the opportunity to earn real BTC yield offers a major opportunity to get the most out of BTCFi. We’re excited to hopefully play a key role in BTCFi’s growth.”

Whales and institutions don’t want to sell Bitcoin, what to expect

Crypto intelligence tracker Santiment predicts an incoming capitulation in Bitcoin. In crypto, capitulation is when a large number of investors sell an asset due of fear of a steeper correction in the token’s price and a prolonged price drop is typically followed by a recovery in the token’s price.

Santiment evaluated the number of non-empty wallets on the Bitcoin blockchain and identified a decline, meaning retail traders and investors are likely dumping their holdings for fear of losses, while whales and large entities continue to accumulate BTC.

Within the last three weeks, Bitcoin blockchain’s number of non-empty wallets declined by 277,240, a significant drop, according to Santiment.

In the long term, this behaviour is typical of “capitulation” and supports a bullish thesis for Bitcoin in 2025.

Bitcoin price forecast for February 2025

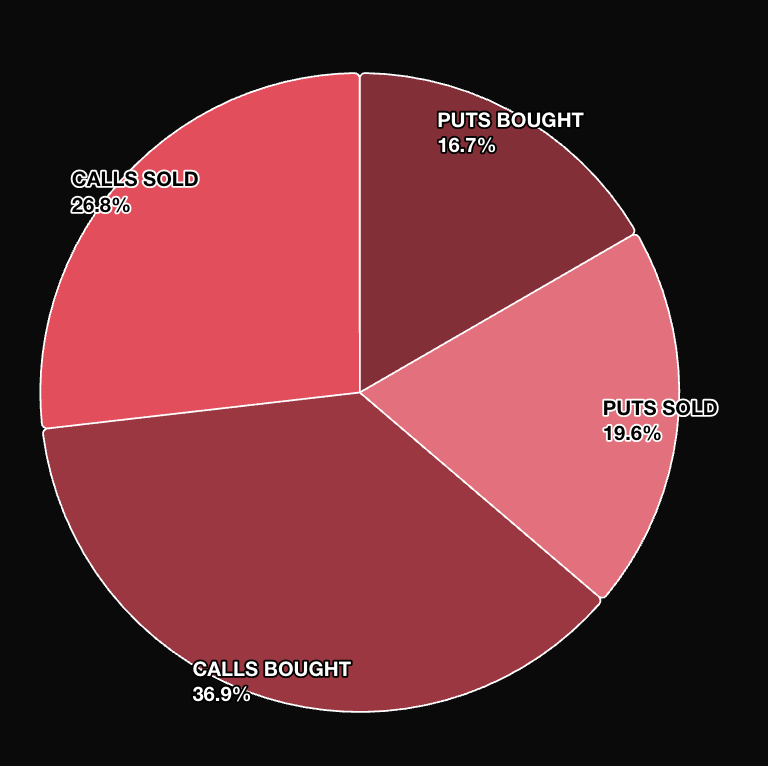

Evaluating derivatives market data on Derive.xyz, it is observed that 47.3% of all premiums were calls sold and 24.4% calls bought, indicating traders are expecting some upside but with capped potential.

Dr. Sean Dawson, Head of Research at Derive.xyz told Crypto.news that:

“We’re experiencing a temporary lull in volatility as the market recovers from last week’s turbulence caused by Trump’s tariff announcements.

BTC At-the-Money (ATM) 7-day Implied Volatility (IV) dropped 7 percentage points – from 47% to 40% over the last 24 hours and BTC’s chance of hitting $125,000 by June 27 has improved to 44.4%, up from 41.9%.”

Dr.Dawson maintains an optimistic outlook on Bitcoin price in the near and long-term.

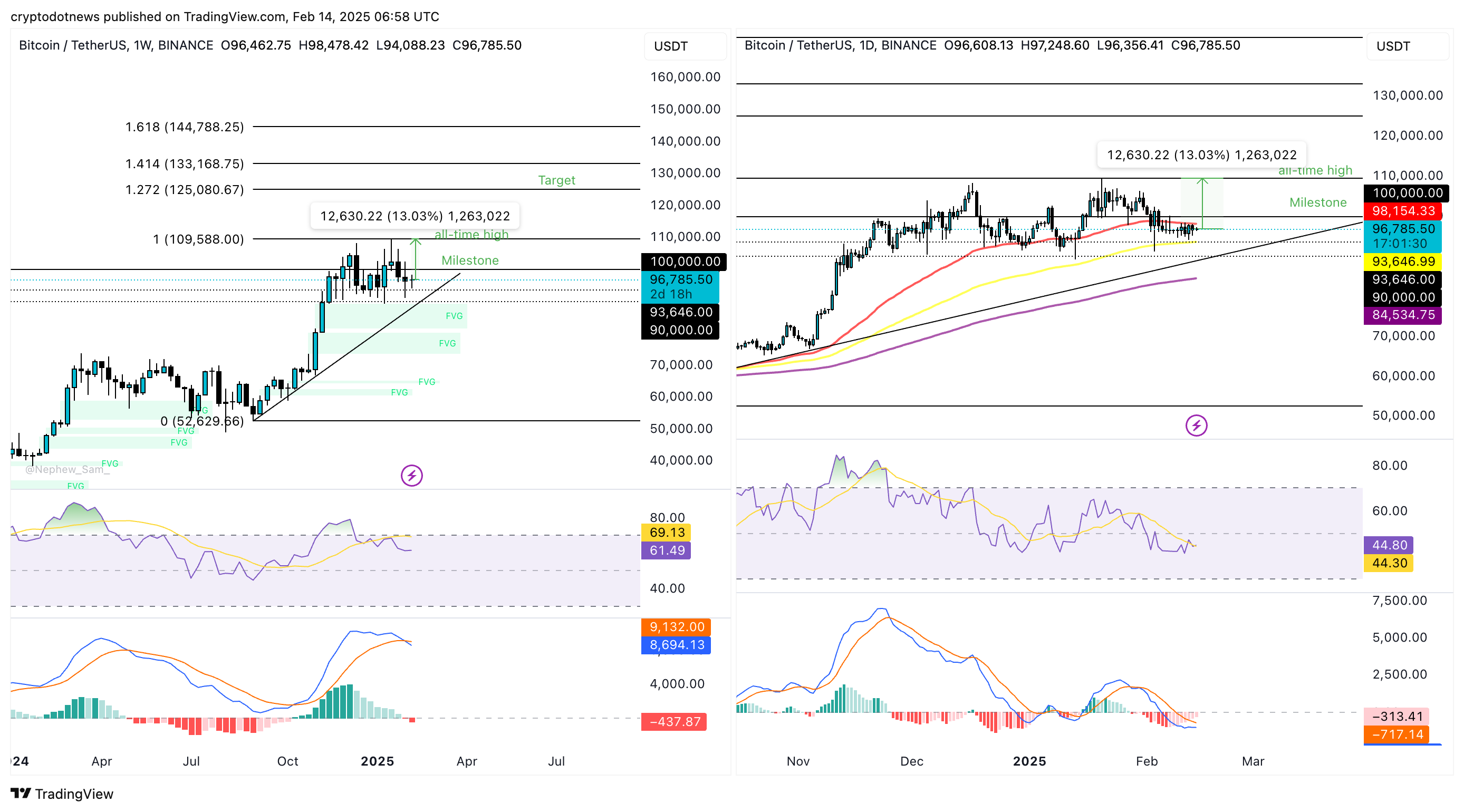

To forecast Bitcoin price for February 2025, we analyze the weekly and daily price chart for BTC/USDT. On the daily timeframe, technical indicators support a bullish thesis and a likely return to test the all-time high of $109,588.

RSI reads 44 and is sloping upwards, MACD flashes red histogram bars that are consecutively shorter meaning underlying negative momentum in Bitcoin price trend is likely waning.

BTC could face resistance at the $100,000 milestone and find support at two key levels, $93,646 and $90,000 on the daily timeframe. The three EMAs identify $98,154, the 10-day EMA, as a resistance level to watch and the $84,534 level, the 200-day EMA, as a key support for Bitcoin.

On the weekly timeframe, Bitcoin is 13% away from its all-time high, a re-test is likely in February 2025, however traders need to watch the price trend closely. Both MACD and RSI are momentum indicators that are neutral or bearish. RSI reads 61, under the “overvalued” zone at 70, and MACD flashes a red histogram bar under the neutral line after weeks of positive underlying momentum in Bitcoin price.

While there is a possibility of a correction, a recovery is likely, and the $100,000 milestone is a key level to watch in the coming weeks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

This article first appeared at crypto.news