The BTC/USD pair is trading sideways, maintaining a narrow range of $16,750 to $16,900 on December 8, but Bitcoin price prediction remains bearish following the breakout of an upward channel.

Bitcoin has dropped 75% this year from its previous high of $69,000. However, the cause of these massive drops could be attributed to various factors.

Recently, everything has negatively impacted the cryptocurrency market, contributing to losses in the world’s largest cryptocurrency, Bitcoin, whether it’s the dramatic collapse of FTX or increasing selling pressure as whales reduce their inflow volumes.

Aside from the FTX collapse, BTC declines could be attributed to the miner capitulation risk continuing to haunt traders looking to enter long positions.

Furthermore, according to ClimateTech Vice Chair Daniel Batten, nearly 29 mining companies account for 16.48% of the entire Bitcoin (BTC) network and use 90% to 100% renewable energy. Thereby, the BTC prices have not yet been impacted by this news.

On the plus side, PayPal, a major financial services provider, plans to launch cryptocurrency services in Luxembourg, which appears to be an effort to expand the use of cryptocurrencies across the European Union.

This news was regarded as one of the most important factors that could assist BTC prices in limiting further losses.

Meanwhile, Binance CEO Changpeng Zhao stated that there are no outstanding loans on the exchange and urged anyone to confirm this claim. This may be good news for cryptocurrency investors and the industry as a whole.

Miner Capitulation Poses a Serious Risk In the Bitcoin Price

Bitcoin’s downtrend could be linked to the increased risk of miner capitulation, which continues to frighten traders attempting to open long positions and puts pressure on the price of BTC.

Miners are selling their Bitcoin holdings due to tight budgets, according to on-chain statistics. The result is visible in the declining share values of mining companies.

The value of NASDAQ-listed cryptocurrency mining firms such as Marathon Digital, Core Scientific, Riot Blockchain, Hut 8 Mining, HIVE Blockchain Technologies, and many others have fallen by 46%, 20%, and 38% in a month over the last six months, respectively, and the problem has gotten worse this month.

This month saw a decrease in mining activity, resulting in a decrease in hashrate and mining difficulty. The mining industry is under pressure due to low coin values, rising energy costs, and heavy debt loads.

As a result of financial hardship and declining stock values, companies will eventually go bankrupt, with Bitcoin being dumped as a last resort. It is also worth noting that miners’ BTC reserves have decreased by 13K BTC. According to Glassnode, it is currently at a 14-month low of 1,818,280.032 BTC.

CZ Confirms About Zero Outstanding Loans On the Exchange

Binance CEO Changpeng Zhao stated that the exchange has no outstanding loans and urged anyone to confirm this claim. Binance issued a Bitcoin proof of reserves earlier on November 25 to show that its on-chain reserves of 582,485.9302 BTC were 1% greater than total client deposits of 575,742 BTC.

Binance’s Bitcoin reserve was overcollateralized by more than 100% of its total liabilities, according to a report released on December 7 by renowned financial auditing firm Mazars. As a result, this was regarded as one of the major factors that could boost investor confidence.

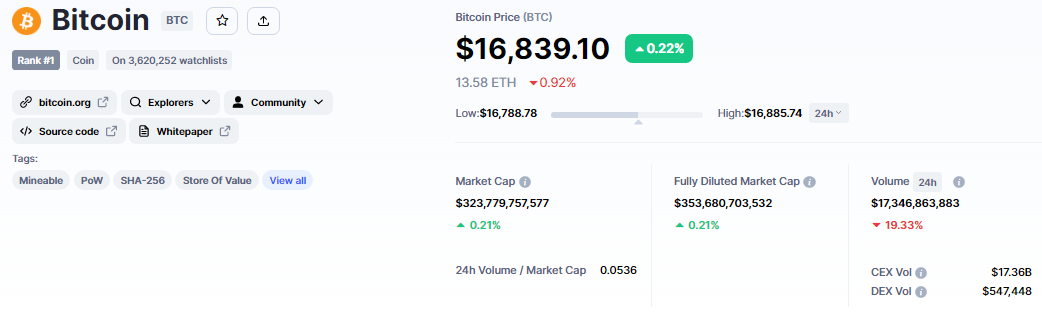

Bitcoin Price

Bitcoin’s current price is $16,844, and the 24-hour trading volume is $17 billion. The BTC price is mostly unchanged today, having gained only 0.20%, while Ethereum, the second-leading cryptocurrency, has gained nearly 1%.

If Bitcoin prices stay below $16,900, a significant technical resistance level, more losses will likely come. On the 4-hour timeframe, the $16,900 level acted as support and was extended by an upward trendline; however, the presence of Doji candles indicates that a downtrend may be forming.

When looking at the downside, $16,500 is the next level of support for Bitcoin. If this level is breached, the price of BTC could fall even further to $16,000 or $15,450.

If Bitcoin cannot sustain its recent selling trend and instead displays a bullish break above $17,000, then a healthy rally to at least $17,350 is to be expected. If the bullish trend continues, Bitcoin’s price may reach $17,650 or $18,000.

Massive Upside Potential Coins

Despite the bearish price action, the coins below are going from strength to strength catching the attention of crypto whales.

IMPT – Presale Ends In 4 Days

The IMPT presale has now raised nearly $15 million as early investors rush to purchase the altcoin before it is listed on exchanges in seven days. The sale is scheduled to end in less than four days, followed by confirmed listings on Uniswap, LBANK Exchange, and Changelly Pro.

Since these listings have already been confirmed, the IMPT sale has gained momentum in its final stages.

At the same time, the Ethereum-based carbon credit marketplace’s fundamentals place it in a strong position to secure long-term growth, with the platform already proving popular with ESG-focused cryptocurrency investors.n

IMPT has raised more than $15 million in its presale so far with 1 IMPT currently selling for $0.023.

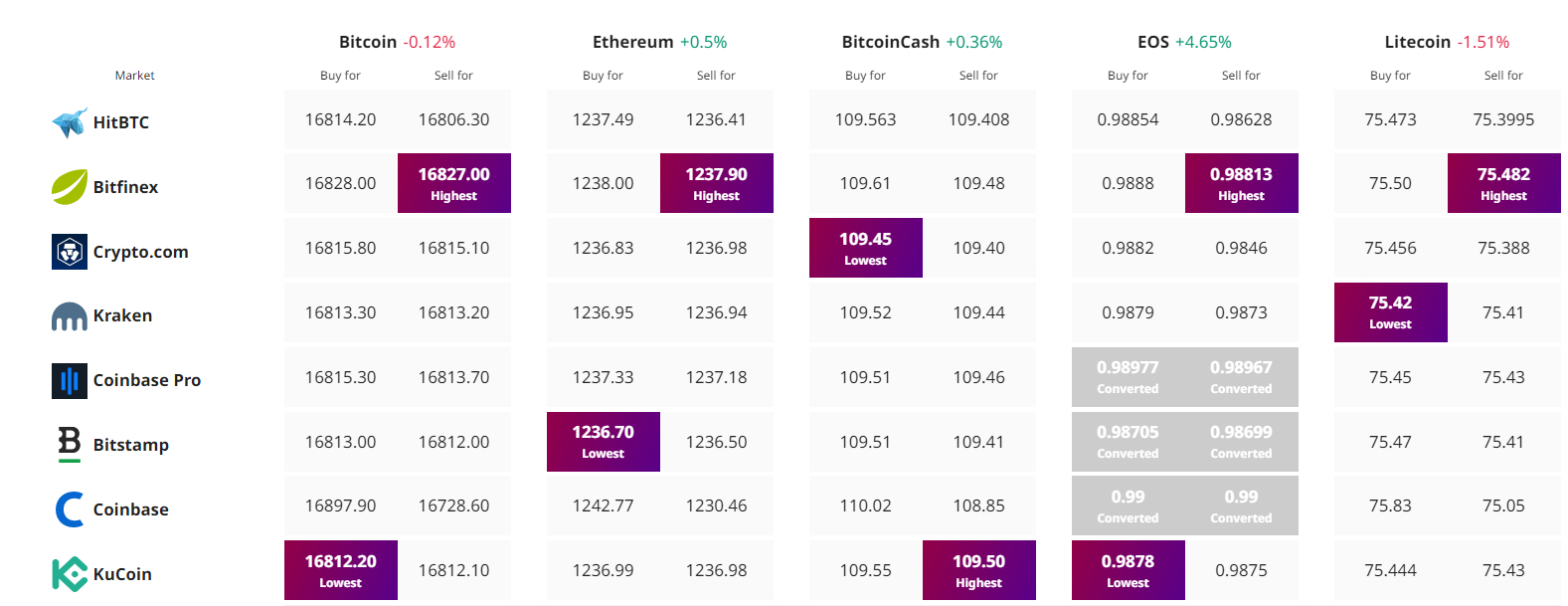

Find The Best Price to Buy/Sell Cryptocurrency

This article first appeared at Cryptonews