Bitcoin mining stocks trended lower as volatility in the cryptocurrency continued.

Marathon Digital, the biggest mining company, dropped by 2.3% on Aug. 28, marking a 38% decline from its highest point this month. CleanSpark stock fell by 1.75% to $11.25, while Riot Platform dropped by over 1.4%. Other large Bitcoin (BTC) mining stocks like Argo Blockchain, Core Scientific, TeraWulf, and Cipher Mining also pulled back.

Most of these stocks remain in a deep bear market after falling by over 20% from their highest level this year.

Their performance is closely tied to Bitcoin’s price action since March. After peaking at a record high of $73,800, Bitcoin has retreated by 18.78% to $60,000. Generally, Bitcoin miners thrive when BTC is rising and vice versa.

Additionally, these companies have struggled due to the Bitcoin halving event in April, which has pushed the hash rate higher. Most of them have mined fewer Bitcoins than they did before the halving event.

Marathon Digital mined 894 coins in March and 692 in July. Similarly, CleanSpark mined 806 coins in March and 494 in July while Riot Platforms produced 425 coins in March and 370 in July.

As a result, these companies are battling the dual effects of lower mining production and declining Bitcoin prices.

Some of them are dealing with the crisis differently. Bitfarms, a leading Canadian miner, acquired rival Stronghold Digital this month. Riot Platforms has also trained its eyes on Bitfarms and has become one of its top shareholders.

Marathon Digital has started mining Kaspa (KAS) and has continued accumulating Bitcoin holdings. Earlier this month, it bought Bitcoins worth $249 million, becoming the second corporate BTC holder after MicroStrategy.

Bitcoin price to support mining stocks

The price of Bitcoin mining stocks will largely depend on Bitcoin’s price action. There are a few catalysts that could push BTC prices higher.

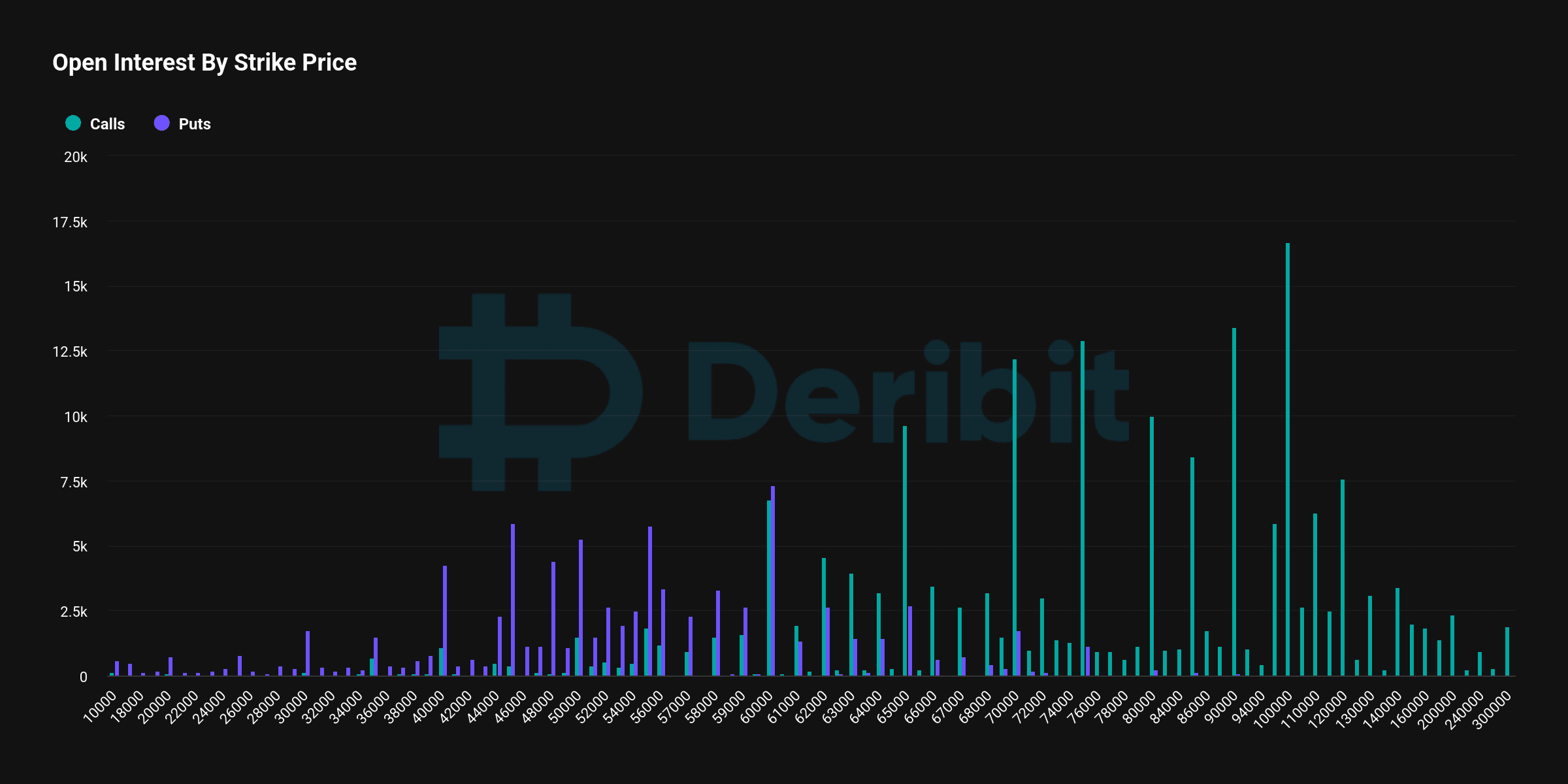

Data in the options market shows that the Aug. 30 expiry has 93% of all call options being Out-of-the-Money, with a strike price above $60,000. A call option gives a holder the right but not the obligation to buy an asset.

However, in the long term, the options market is predicting a potential rally to $90,000 by the end of the year.

Bitcoin continues to see strong inflows in the ETF market. While funds suffered outflows of $127 million on Aug. 27, they have added over $17.95 billion this year. Blackrock’s ETF has over $22.2 billion in assets while Fidelity’s fund has $11 billion and is about to pass Grayscale’s Bitcoin Trust.

Other potential catalysts for Bitcoin include the upcoming Federal Reserve interest rate cuts, a potential Donald Trump victory, the return from summer, soaring US debt, and institutional demand.

If these catalysts align and Bitcoin rebounds, there is a high chance that most Bitcoin mining stocks will bounce back.

This article first appeared at crypto.news