Share this article

Bitcoin’s perpetual futures markets are currently experiencing high funding rates, signaling a premium for long positions and further correction for spot prices, according to the “Bitfinex Alpha” report’s latest edition.

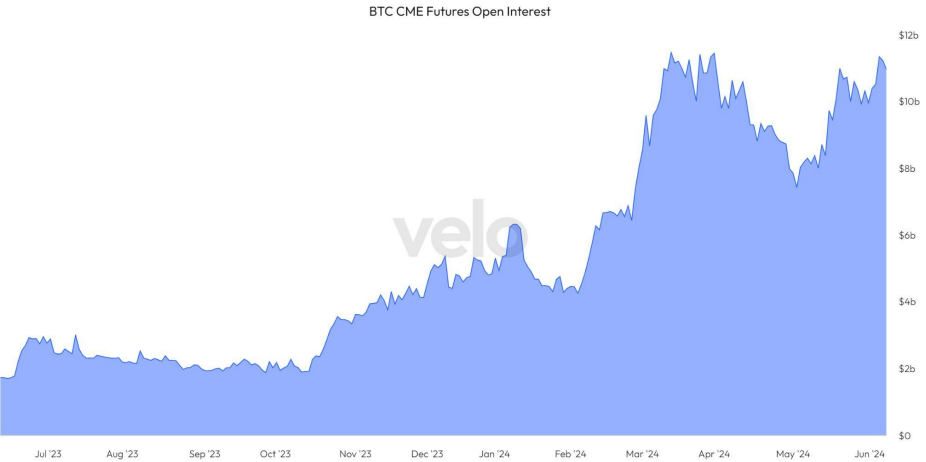

The rising Bitcoin CME futures open interest, reaching $11.4 billion as of June 4th, parallels the March all-time highs before a notable price correction. Traders appear to be leveraging the basis arbitrage opportunity, shorting Bitcoin on the open market while gaining spot exposure through ETFs, aiming to profit from futures and spot market price discrepancies.

Despite 20 consecutive days of ETF inflows since May 10, potential disruptions loom with the upcoming US Consumer Price Index report and the US Federal Open Market Committee’s interest rate discussions set to happen this week.

Last week, Bitcoin’s price fluctuated, reaching over $71,500 and then correcting to local lows around $68,500. Major altcoins experienced declines, with Ethereum (ETH) and Solana (SOL) dropping 7.5% and 12.1%, respectively.

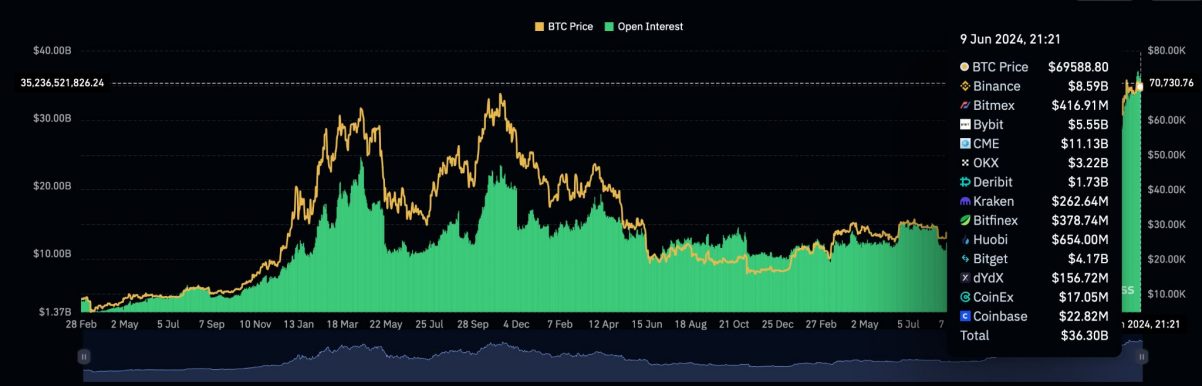

The recent “leverage flush” saw significant liquidations in altcoin leveraged longs, with Coinglass data showing Bitcoin open interest at an all-time high of $36.8 billion on June 6th.

Nevertheless, short-term holders have increased their Bitcoin activity, with holdings peaking at 3.4 million BTC in April. Long-term holders, on the other hand, are demonstrating confidence by accumulating Bitcoin, with the inactive supply for one-year holders remaining stable.

Bitcoin whales are also on an accumulation spree, with their balance reaching a new historical high.

Therefore, although derivatives data suggest a price pullback in the short term, factors such as increased ETF buying activity, reduced selling pressure from long-term holders, and improved liquidity could potentially catalyze Bitcoin’s upward movement in the long term.

Share this article

This article first appeared at Crypto Briefing