Bitcoin’s price fell to a weekly low of $50,600 on Feb. 23, down 5% in the last three days, but a rare buying frenzy observed across Korean exchanges provides fresh market insights.

Cryptocurrency exchanges in South Korean markets have witnessed an uptick in Bitcoin (BTC) trading this week. Historical trends suggest that this could significantly impact Bitcoin’s short-term price action.

Korean investors increase buying pressure amid falling prices

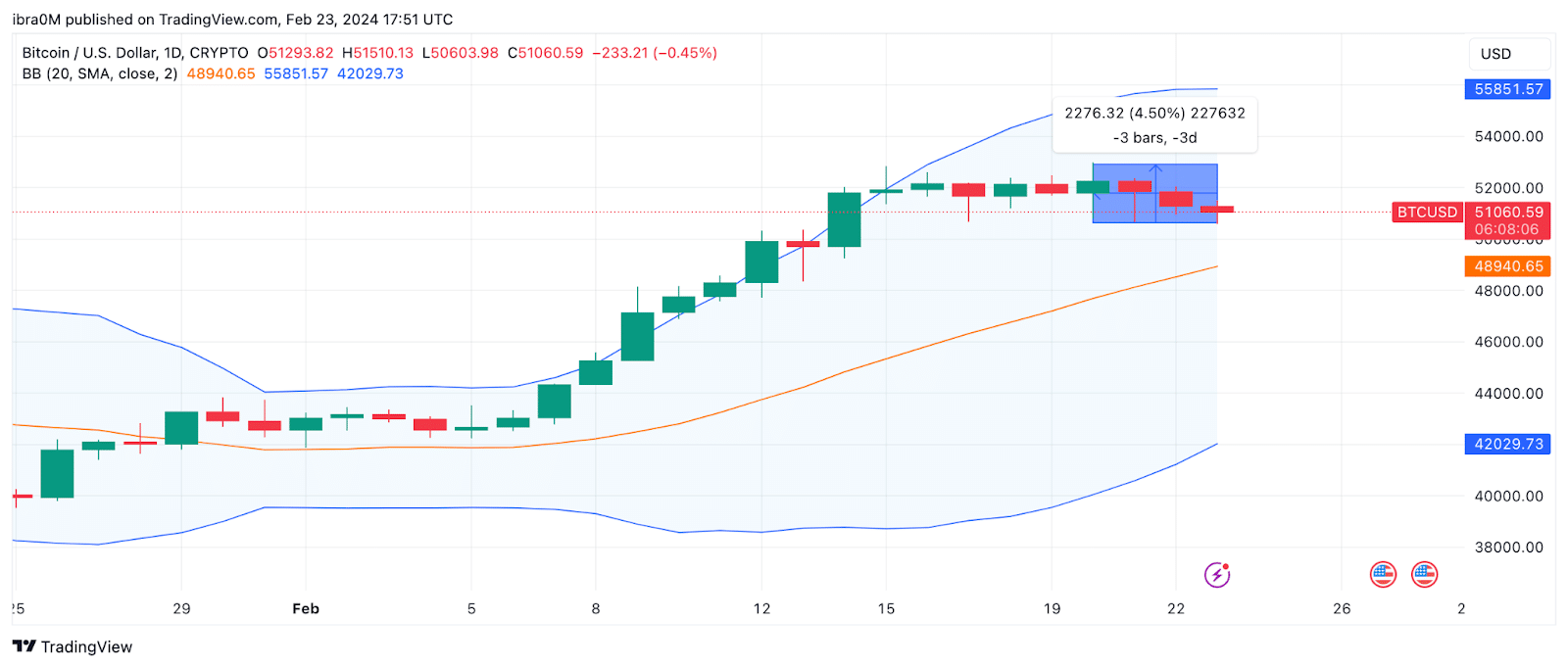

Following a blistering 27% uptrend in the first half of February, Bitcoin’s price has struggled to sustain the momentum this week. After hitting a yearly peak of $52,985 on Feb. 20, BTC price has now tumbled 5% to a new weekly low of $50,600 at the time of writing on Feb. 23.

Earlier this week, crypto.news reported on South Korean political parties espousing pro-crypto policies favoring ETFs and delays on additional taxes. A rare buying trend has emerged among crypto investors in South Korean markets amid the falling Bitcoin price.

However, historical trends suggest this could further exacerbate Bitcoin’s ongoing price dip.

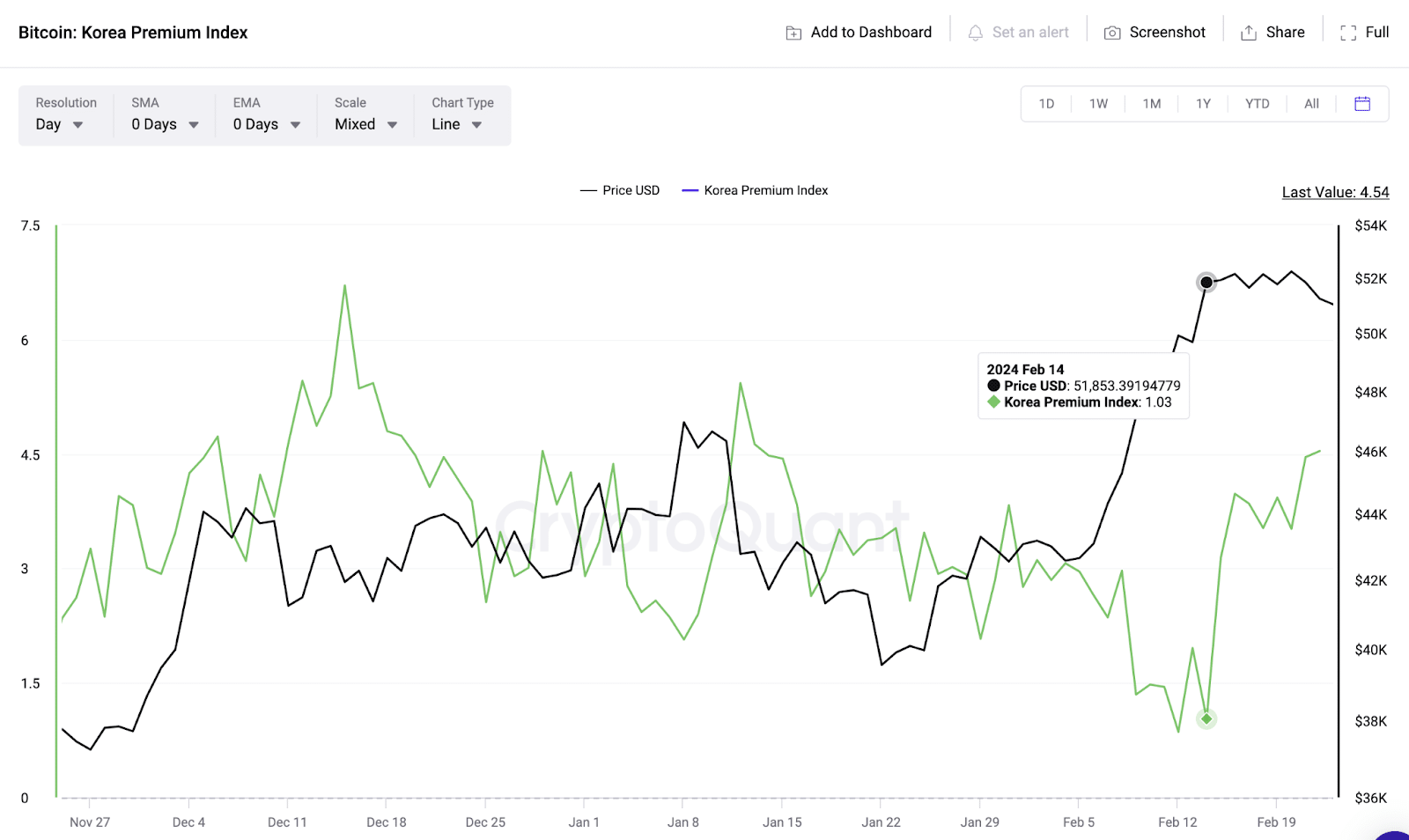

CryptoQuant’s Korean Premium (KP) Index tracks the price gap between South Korean exchanges and other exchanges. Rising values suggest increased buying activity among Korean investors and vice versa.

The KP index has spiked 400% from 1.03 to 4.54 between Feb. 14 and Feb. 23, coinciding with Bitcoin’s ongoing price correction.

Historically, there has been a noticeable correlation between the BTC price and the Korean Premium Index. When the KP Index spikes, indicating heightened buying activity among Korean investors, Bitcoin’s price often experiences downward pressure or negative correlation.

Bithumb, Upbit, Coinone, and Korbit are the leading crypto exchanges in South Korea, known as “The Big Four.” These platforms host 90% of all crypto assets held by the country’s residents, according to Seoulz.com research

The long-term inverse relationship with BTC prices suggests that fluctuations in the Korean market can influence broader market sentiment and contribute to price volatility in the cryptocurrency ecosystem.

Bitcoin price prediction: BTC Can Find Support at $48,900

If this rare negative divergence between Bitcoin price and Korean market activity repeats, BTC will likely dip below $50,000. Furthermore, with Bitcoin ETFs due to close trading for the week of Feb. 23, institutional demand for BTC will likely decline further in the days ahead.

Capitalizing on these critical factors, bears could make a brazen attempt to force a rapid downswing toward $45,000.

In this scenario, Bitcoin losing the $50,000 support could trigger a freefall toward the 20-day SMA price of $48,942. Considering the overall sentiment surrounding the crypto markets is still largely bullish, BTC bulls could mount a consolidation buy-wall at that key support level.

On the other hand, Bitcoin could receive a demand surge from leveraged bullish investors looking to avert margin calls at the $50,000 level. In this case, Bitcoin price could experience an upswing toward the next significant resistance at the $55,500 area, as depicted by the upper Bollinger Band indicator.

This article first appeared at crypto.news