Bitcoin (BTC) has gained a slightly bullish momentum after its fall from the $70,000 mark. The small push comes as the BTC total open interest (OI) plunged by over $1 billion.

BTC is up by 0.6% in the past 24 hours and is trading at $66,500 at the time of writing. The asset’s market cap surged to $1.3 trillion with a daily trading volume of $44 billion.

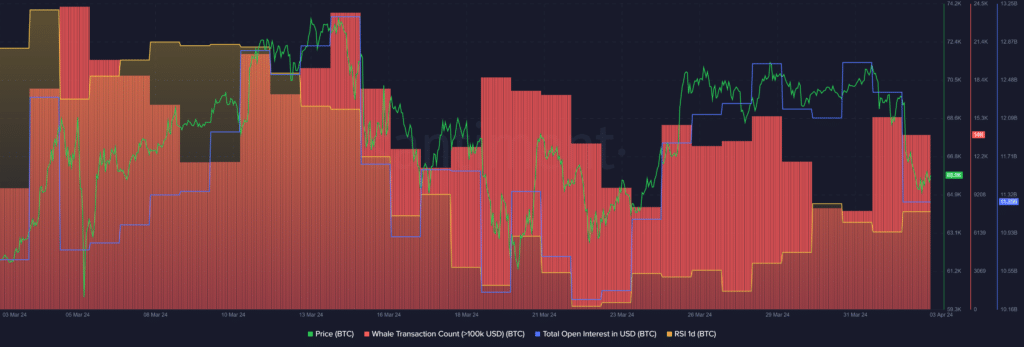

According to data provided by Santiment, the total Bitcoin OI recorded a 9% drop over the past day — falling from $12.36 billion to $11.25 billion. A sudden change in open interest could usually cause higher price volatility for an asset.

Moreover, the number of whale transactions consisting of at least $100,000 worth of BTC dropped from 15,454 to 14,020 unique transactions in the past 24 hours, per data from Santiment. The declining whale activity comes as the global crypto greed and fear index falls to a one-month low of 71.

Data shows that the Bitcoin Relative Strength Index (RSI) rose from 54 to 57 over the past 24 hours. The indicator suggests that the flagship cryptocurrency is witnessing slightly increased pressure and volatility.

An RSI of below 50 would potentially signal a bullish momentum for Bitcoin.

One of the main reasons behind the increased RSI could be the Bitcoin miners’ profit-taking phase. Per a crypto.news report, BTC miners earned more than $2 billion last month, breaking the previous all-time high of $1.7 billion which was recorded in May 2021.

This article first appeared at crypto.news