The Bitcoin price and the broader crypto market have struggled over the past two weeks. With further price declines, investors have started moving funds into the exchanges.

Bitcoin (BTC) plunged to a one-month low of around $53,000 on Sept. 6, bringing strong bearish momentum to the cryptocurrency market. BTC and altcoins saw over $295 million in liquidations a day later.

The Bitcoin price recorded mild gains again that helped the global crypto market cap surpass the $2 trillion mark.

BTC is up by 0.25% in the past 24 hours and is trading at $54,450 at the time of writing. Despite the rebound, the asset’s price is still down by 15% from its local high of around $64,400 on Aug. 25.

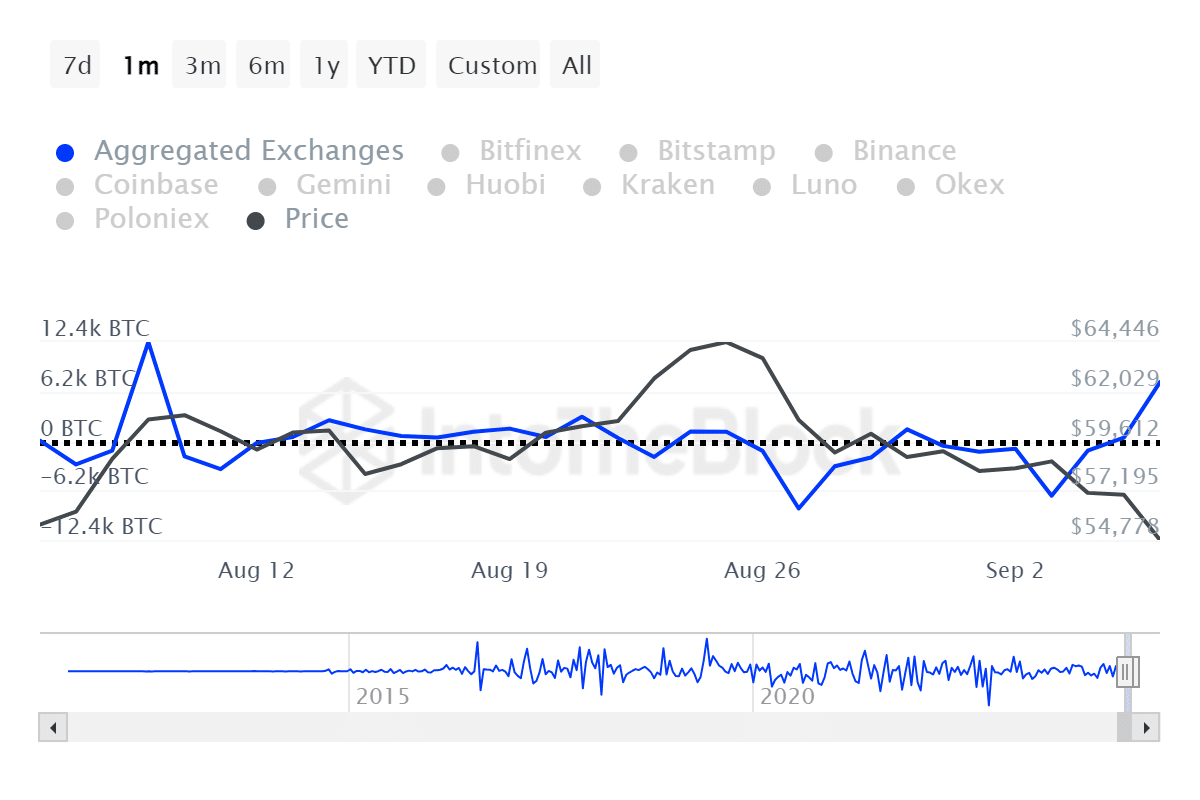

According to data provided by IntoTheBlock, over 7,300 Bitcoins, roughly $400 million, entered the centralized crypto exchanges as its price plunged below the $54,000 mark.

The leading cryptocurrency witnessed a one-month exchange net inflow of 10,310 BTC, worth over $560 million at the reporting time.

Data from ITB shows that whale transactions consisting of at least $100,000 worth of BTC reached a total of $68 billion over the past week.

The large holders’ netflow to exchange netflow ratio is currently sitting at 1.4%, per data from ITB. The indicator shows that whales have been more active than retail wallets amid the declining Bitcoin price.

Notably, retail addresses make up 88.4% of the total Bitcoin holders. Less than 12% of the BTC supply is held in whale wallets, according to ITB.

This article first appeared at crypto.news