Bitcoin reserves on centralized crypto exchanges like Binance and Coinbase have dropped to their lowest levels in years, reinforcing bullish crypto sentiment.

CryptoQuant data confirmed that investors have withdrawn over 171,000 Bitcoin (BTC) from leading crypto exchanges since Donald Trump’s victory in the U.S. presidential election. Mass withdrawals shorten the supply available for sell-offs, often signaling a long-term investment plan adopted by holders.

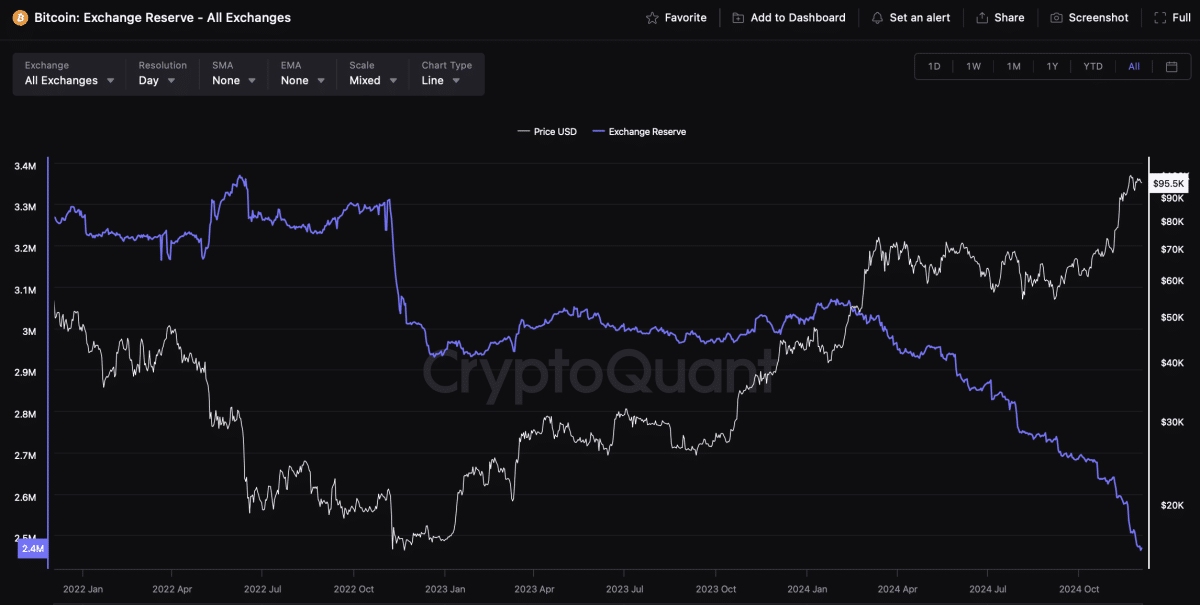

While data showed staggering Bitcoin exchange outflows after President Trump’s victory, the trend extends back to 2021. Bitcoin exchange reserves steadily dwindled since crypto’s previous peak, marking strong belief in BTC despite market drawdowns in 2022 and 2023.

By October 2021, exchange holdings were noted at 3.2 million BTC. According to CryptoQuant, this level had dropped to 2.46 million tokens at press time. Glassnode echoed CryptoQuant’s data, showing an increase in short-term dormant BTC. The platform’s illiquid supply metric, which tracks long-term investor holdings, grew by 185,000 Bitcoin in the past 30 days.

Around 75% of BTC’s current supply, some 14.8 million coins, has been inactive since early November. This pattern may extend into 2025 as Trump implements crypto-friendly policies and BTC adoption skyrockets.

The world’s top cryptocurrency accelerated to a $99,600 peak weeks after President Trump was re-elected. Bitcoin and the broader digital asset market corrected price ascents on Dec. 3 amid political upheaval in South Korea and profit rotation into altcoins like Ripple (XRP).

However, experts like Fundstrat Capital CIO Thomas Lee predict an incoming supply shock and a rise above $100,000 before the end of 2024.

This article first appeared at crypto.news