Bitcoin declined over 5% on March 22 as spot ETFs recorded negative numbers for the fourth consecutive day, mainly due to Grayscale GBTC exits.

According to SoSo Value, 10 spot Bitcoin (BTC) ETFs marked $93.8 million in cumulative single-day outflow during trading on March 21. Grayscale’s GBTC accounted for most of the BTC ETF share liquidation, amounting to $358 million.

Bloomberg’s James Seyffart verified that Grayscale’s BTC ETF has lost nearly half of its shares to sell orders following the approval of spot BTC ETFs on Jan. 11.

Seyffart concurred with fellow analyst Eric Balchunas that some of GBTC’s liquidation may be attributed to Gemini and Genesis. Bankruptcy crypto exchange FTX also liquidated $2 billion in Grayscale shares, crypto.news reported in January.

Outflows from GBTC overshadowed inflows into eight other products. BlackRock’s BTC ETF garnered over $223 million in demand, followed by $12 million injected into the fund from Bitwise. Data showed that the WisdomTree failed to receive inflows for at least the second time.

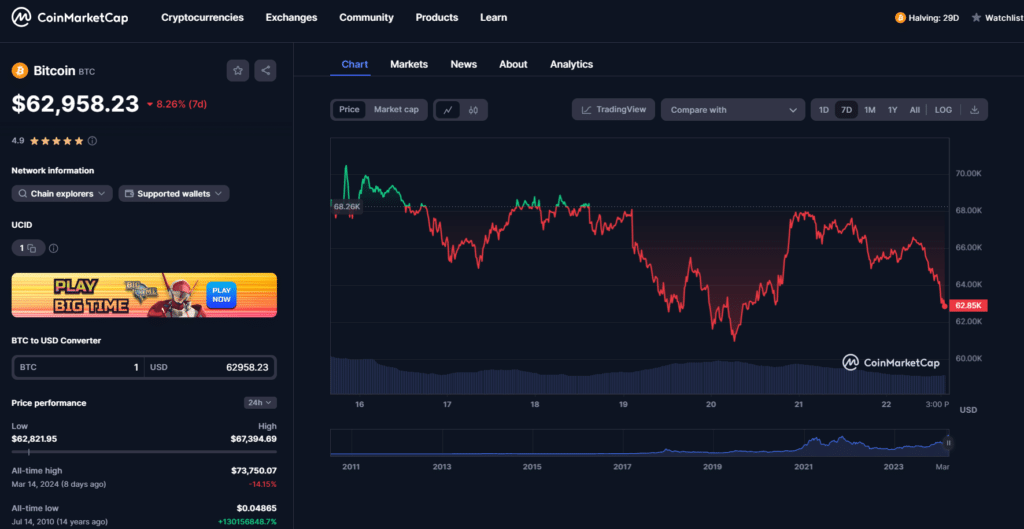

Bitcoin down 8% in a week

Bitcoin retraced over 8% in the past week after falling below $63,000, per CoinMarketCap. BTC has dropped 14% from its $73,750 all-time high set on March 14. The world’s largest cryptocurrency traded around $62,900, roughly a month away from its quadrennial halving event.

Investment advisor at neobank Keytom, Evgeny Filichkin, echoed the general sentiment that the halving combined with spot BTC ETFs demand will catalysize a supply shock and likely trigger a parabolic run.

Following the halving event, the supply of new BTCs will decrease, causing market dynamics to intensify. With increasing demand and limited availability, the heightened scarcity will amplify Bitcoin’s appeal, driving further investment interest.”

Evgeny Filichkin, Keytom investment advisor

This article first appeared at crypto.news