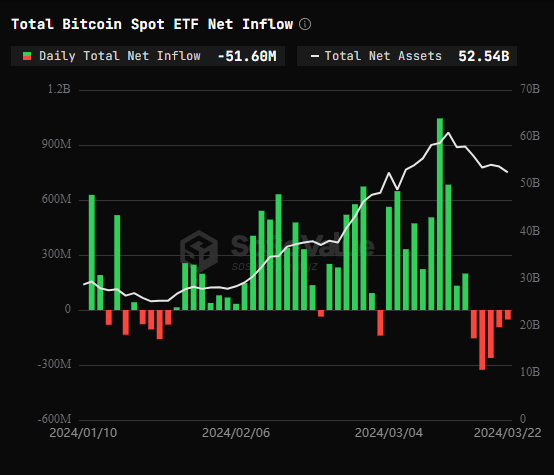

Spot Bitcoin exchange-traded funds (ETFs) reported total net outflows of $51.6 million on Friday, marking the fifth day of consistent withdrawals.

Among these, the Grayscale ETF (GBTC) experienced a substantial single-day net outflow of $169 million. In contrast, the BlackRock ETF (IBIT) and Fidelity ETF (FBTC) saw modest single-day net inflows of $18.89 million and $18.13 million, respectively, both reaching two-day record lows.

Despite this downward trend, there’s a silver lining as the rate of outflows appears to be decelerating. The most significant drop happened on Tuesday, with over $323 million exiting across all 10 ETFs. Correspondingly, Bitcoin’s value dipped to $62,000 on the same day.

However, as the outflow slows, Bitcoin has started to bounce back, showing a near 3% increase today, pushing its price up to $64,600.

Analysts have suggested that ETF demands could resurface as the largest cryptocurrency reaches certain support levels.

The upcoming halving could also see renewed interest from institutional investors in these ETFs.

This recent activity underscores a strong correlation between Bitcoin ETF movements and the BTC’s market value.

Earlier in the month, when Bitcoin ETFs enjoyed a record influx of $1 billion, the price of BTC soared to an all-time peak of $73,700.

This article first appeared at crypto.news