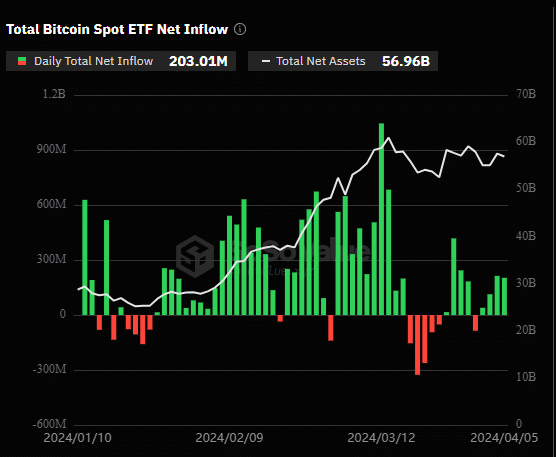

Spot Bitcoin ETFs, or exchange-traded funds, witnessed a net inflow of $203 million on Friday, April 6, continuing a trend for the fourth straight day.

According to SoSoValue, Grayscale’s ETF, GBTC, saw its net assets decrease by $198 million on the same day, pushing its total net withdrawals to $15.51 billion.

Meanwhile, BlackRock’s iShares Bitcoin Trust, which trades under the ticker IBIT, led the market with a single-day inflow of $308 million, raising its total inflows to $14.77 billion.

Bitcoin ETFs saw a net outflow of $85.8 million on Monday, April 1 — the only net outflow in the past ten days of trading. Consequently, BTC price dropped to $65,000, triggering broader liquidations across the market.

However, the four consecutive days of inflows have helped Bitcoin recover over $67,000.

Institutional investments have played a significant role in BTC’s market movements since the SEC approved Bitcoin ETFs in January.

Despite the recent price corrections, close observers (i.e., SkyBridge’s Anthony Scaramucci) predict a larger rally for the premier cryptocurrency following its halving later this month. See below.

Bitcoin Cash (BCH), a fork of Bitcoin, rallied over 10% immediately after its halving last week.

The market is anticipating a similar impact on the BTC market, as recent reports showed that the token increased by an average of 3,230% after each of the last three halving.

This article first appeared at crypto.news