Share this article

Bitcoin exchange-traded funds (ETF) in the US experienced a significant week of outflows, which is seen by Bitfinex analysts as a local bottom for crypto. A total of $544.1 million left the funds in what was highlighted in the “Bitfinex Alpha” report as “a mix of basis/funding arbitrage unwinding, due to negative funding rates, and investors’ reactions to short-term negative news.”

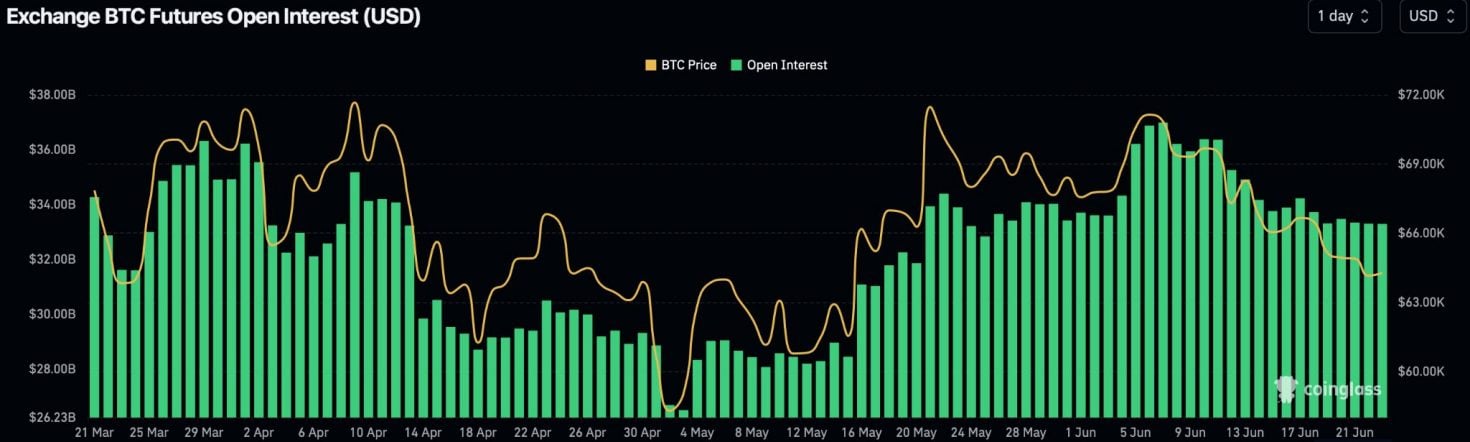

Additionally, aggregated Bitcoin (BTC) open interest also fell by over $450 million, with total BTC futures open interest now at $33.3 billion, down from the June 7th high of nearly $37 billion.

These movements align with negative funding rates seen across exchanges, suggesting a substantial unwinding of funding arbitrage trades linked to ETF flows. However, Bitfinex cautions that not all ETF outflows directly translate to spot selling. Historical data indicates that ETF outflows often precede the formation of local bottoms in BTC price, a pattern that seems to be repeating.

Despite a significant BTC sale by the German government and a broader market downturn, MicroStrategy’s recent purchase of 11,931 BTC for $786 million provided some counterbalance.

Market volatility patterns continue to offer potential indicators for market turns, with Thursdays and Fridays showing the most significant price movements. The recent “triple witching” event in US stock markets also contributed to the volatility, affecting crypto assets due to their correlation with the S&P 500.

Moreover, the report highlights the slump in crypto’s total market cap last week, falling to a low of $2.17 trillion.

The US Dollar Index (DXY) reached a 50-day high of 105.8, indicating a shift away from currencies like the euro, British pound, and Swiss franc. Notably, the DXY has a reverse correlation with BTC, and this movement is negative for crypto in general.

Share this article

This article first appeared at Crypto Briefing