Key Takeaways

- Bitcoin ETFs reached a total of $21 billion in net inflows, a record high.

- ARKB and IBIT were the top performers, significantly contributing to the week’s gains.

Share this article

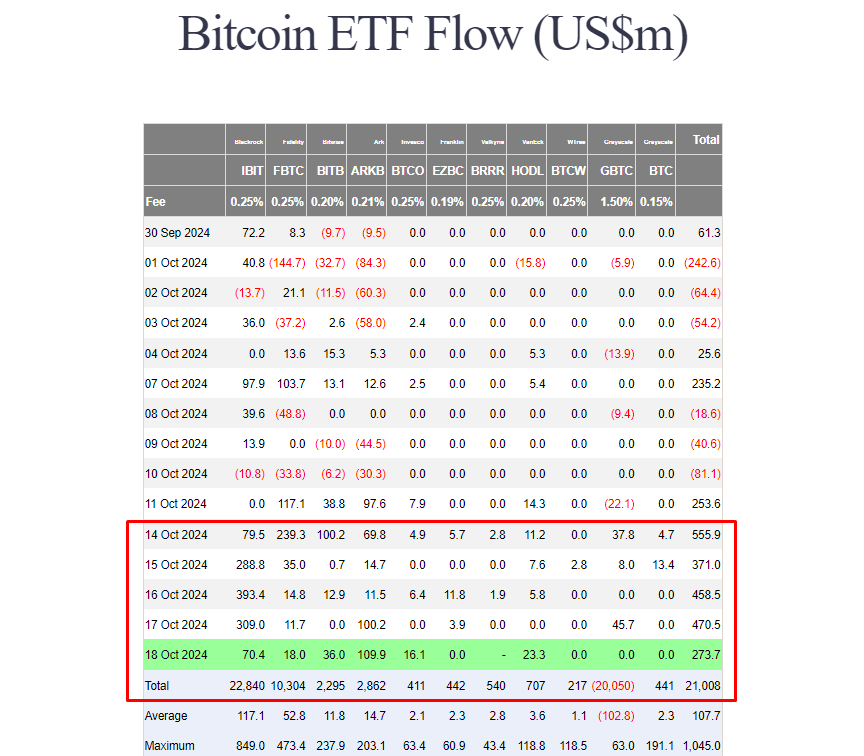

US spot Bitcoin ETFs reached $21 billion in total net inflows on Friday as investor appetite for these funds remains strong. According to data from Farside Investors, these ETFs collectively netted over $2 billion this week, extending their winning streak to six consecutive days.

Yesterday alone, spot Bitcoin ETFs attracted around $273 million in net purchases. ARK Invest’s ARKB led the group with nearly $110 million.

BlackRock’s IBIT also logged over $70 million in net inflows on Friday, followed by VanEck’s HODL, Bitwise’s BITB, Fidelity’s FBTC, and Invesco’s BTCO.

IBIT and ARKB were the top-performing Bitcoin ETFs this week. ARKB experienced a surge in inflows, surpassing $100 million on both Thursday and Friday.

Meanwhile, half of the group’s inflows came from IBIT. As of October 18, its net inflows have topped $23 billion, solidifying its position as the world’s premier Bitcoin ETF.

With Friday’s positive performance, Bitcoin ETFs saw their first week with no negative inflows. Even Grayscale’s GBTC, known for its historical outflow reputation, reversed the trend with over $91 million in net inflows.

Share this article

This article first appeared at Crypto Briefing