Key Takeaways

- Bitcoin has surged past $67,000, only 8% away from its all-time high.

- BlackRock CEO compares Bitcoin to gold, endorsing it as a viable asset class.

Share this article

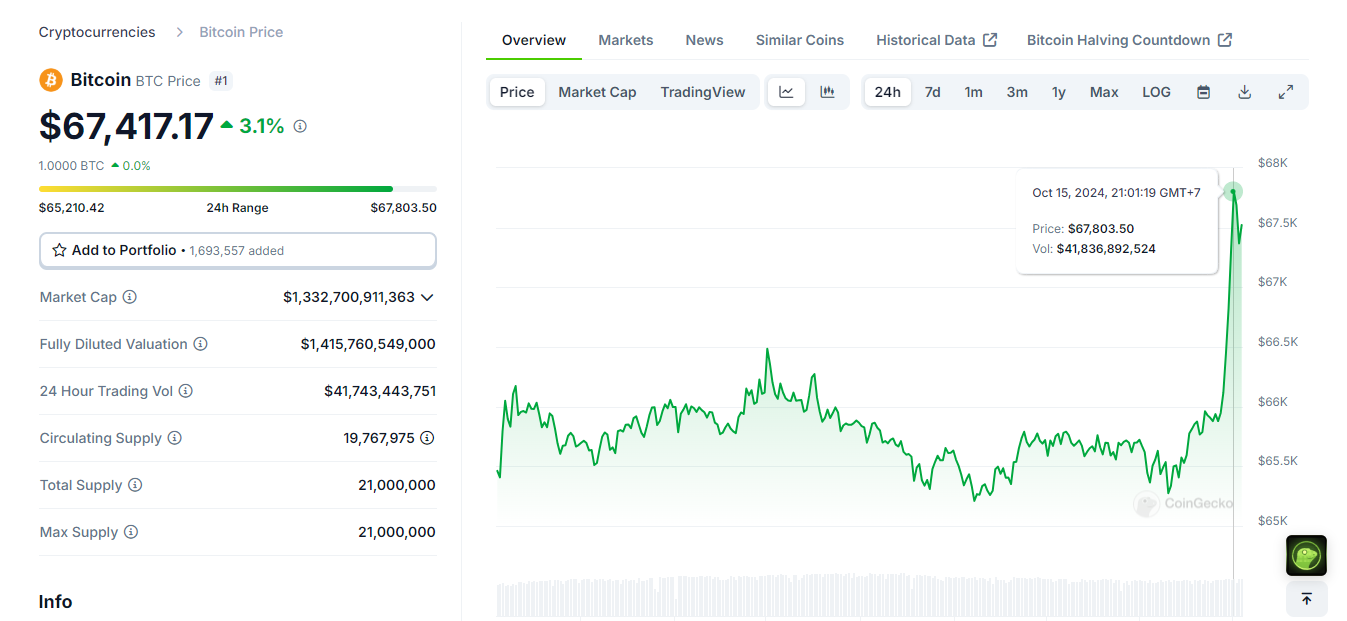

Bitcoin hit a high of $67,800 in the last few minutes, edging closer to the $68,000 and being only 8% away from its record high set in March. The breakthrough comes after BlackRock CEO Larry Fink endorsed Bitcoin as a viable asset class.

During the Q3 2024 earnings call, Fink officially recognized Bitcoin as a distinct asset class, equating it to traditional commodities such as gold. He noted that BlackRock was discussing potential Bitcoin allocations with institutions worldwide.

As of now, Bitcoin’s market cap has reached $1.3 trillion, a figure that proves its growing prominence and acceptance in financial circles. BTC is currently trading at around $67,400, reflecting a 3% increase over the past 24 hours, per CoinGecko.

The upward trend follows a notable 5% gain yesterday, which came amid the strong performance of US spot Bitcoin ETFs. On Monday, these funds collectively drew in around $550 million in net inflows, Farside Investors data shows.

Market sentiment remains bullish with expectations of further increases if Trump secures a victory in the upcoming election. Concurrently, the recent rally comes amid the WLFI token presale of Trump-backed World Liberty Finance. The project raised $5 million in the first hour despite website issues.

Analysts suggest Trump’s involvement could boost the crypto sector, contrasting with Kamala Harris’s more conservative stance on digital assets.

Share this article

This article first appeared at Crypto Briefing