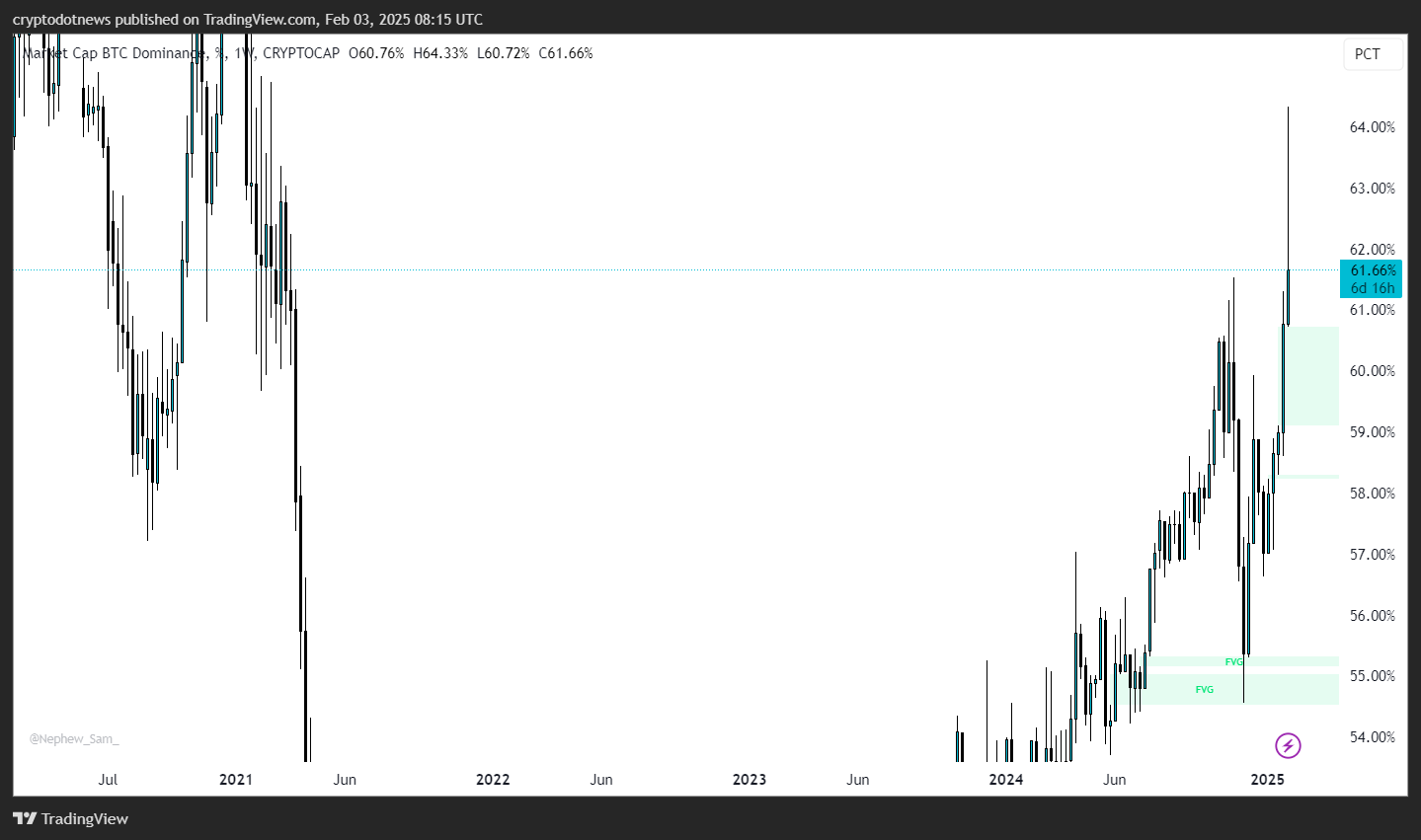

Bitcoin now commands nearly 62% of the total crypto market, its highest level since February 2021. As altcoins struggle, traders are closely watching BTC’s price movement, particularly the $102,000 CME Gap—a crucial level for potential reversals.

As of Feb. 3, Bitcoin’s (BTC) market dominance has climbed to nearly 62%, marking its highest level since February 2021. BTC market dominance measures the share of total cryptocurrency market cap accounted for by Bitcoin. A dominance of 62% indicates that BTC makes up the bulk of the market, leaving altcoins with the scraps.

In February 2021, Tesla announced a $1.5 billion investment in BTC and a commitment to accept it for payments, causing the price to surge above $44,000, according to Reuters.

This momentum continued throughout the year, driven by growing adoption among businesses and organizations, ultimately pushing BTC’s price past $68,000 in November 2021.

The recent drop is explained mainly by fear of a global economic slowdown and anxiety stemming from Trump’s tariff policies against Mexico, Canada, and China. This market downturn has affected the bigger altcoin market.

BTC’s ‘Kimchi Premium,’ the price gap between BTC in South Korea vs. global markets, now stands at 12%—the highest in three years. This highlights the strong demand for Bitcoin in South Korea despite market turbulence.

The CME Gap and Bitcoin dominance

For traders, the CME Gap at $102,436 is a key level to look out for, says CryptoRover, a Key Opinion Leader in the crypto space. CME Gaps occur when BTC’s price makes a significant move whilst the CME futures market is down. Historically, BTC tends to fill these gaps over the weekend, becoming a critical area of interest for traders looking for price reversals or corrections.

While BTC’s dominance strengthens, many predict an upcoming altcoin season by February 2025, similar to previous market cycles.

This article first appeared at crypto.news