Bitcoin price rose for three consecutive days as investors bought the dip ahead of the Donald Trump and Kamala Harris debate and the closely watched U.S. inflation report.

Bitcoin (BTC) rose to $55,700 while Ethereum (ETH) jumped to $2,320. The gains coincided with a positive performance in the stock market, where the Dow Jones, S&P 500, and Nasdaq 100 indices all rose by over 1%. These assets rebounded following the mixed jobs report, which showed that the jobless rate fell to 4.2%, while wage growth strengthened.

Bernstein is bullish on Bitcoin

In a note ahead of the Trump and Harris debate, an analyst at Bernstein predicted that Bitcoin could rise to $90,000 if Trump wins in November. Such a move would represent a 62% increase from its Sep. 8 levels. The analyst also expects the coin to drop to a low of $30,000 if Harris wins.

Bernstein is a major player on Wall Street, as part of AllianceBernstein, a company with over $700 billion in assets under management and a market cap of over $3.8 billion.

The analyst believes that Donald Trump will usher in a more crypto-friendly regulatory environment following the tenure of Gary Gensler, who has been criticized by many in the crypto industry for focusing on regulation through enforcement. During Gensler’s tenure, the SEC has sued companies like Coinbase, Binance, Kraken, and OpenSea.

Trump has vowed to fire Gensler and support the crypto industry. For example, he has stated that he will not allow the sale of Bitcoins currently held by the government. He also aims to promote the U.S. as the leading Bitcoin mining country.

However, history shows that Bitcoin tends to perform well regardless of who is in the White House. It has reached all-time highs under every president since its inception. It peaked at a record high of $73,800 during Joe Biden’s presidency and under Gary Gensler’s oversight.

Federal Reserve rate cuts

Another possible catalyst for Bitcoin is the Federal Reserve’s actions, particularly if this week’s data confirms that inflation is easing. Economists expect the numbers to show that the headline Consumer Price Index retreated to 2.6% in August.

If this is accurate, the Fed may implement a 0.50% rate cut at its September meeting. Bitcoin and other risky assets tend to perform well when the central bank is cutting rates.

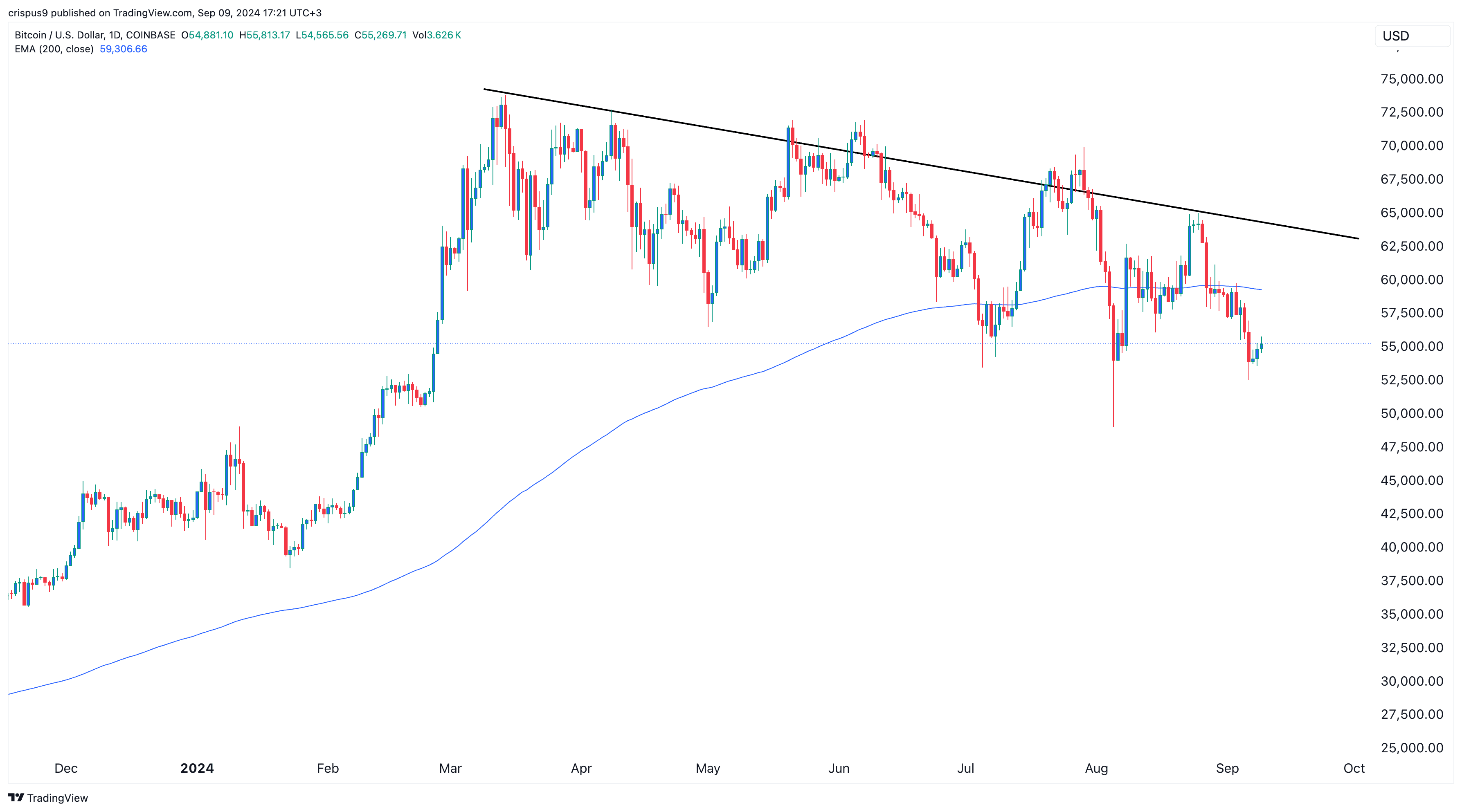

For Bitcoin to reach $90,000, it will need to move past the 200-day Exponential Moving Average at $60,000. It will also need to rise above the descending trendline that connects the highest swings since March.

This article first appeared at crypto.news