As the 2024 Bitcoin halving approaches, Bitcoin (BTC) is struggling to hold above $63,000, and the price is expected to drop even further in what is termed a “correction.”

Crypto analyst Michael van de Poppe took to X to state that the current consolidation is a case of “peaking pre-halving,” and there is still time for Bitcoin to hit a new all-time high.

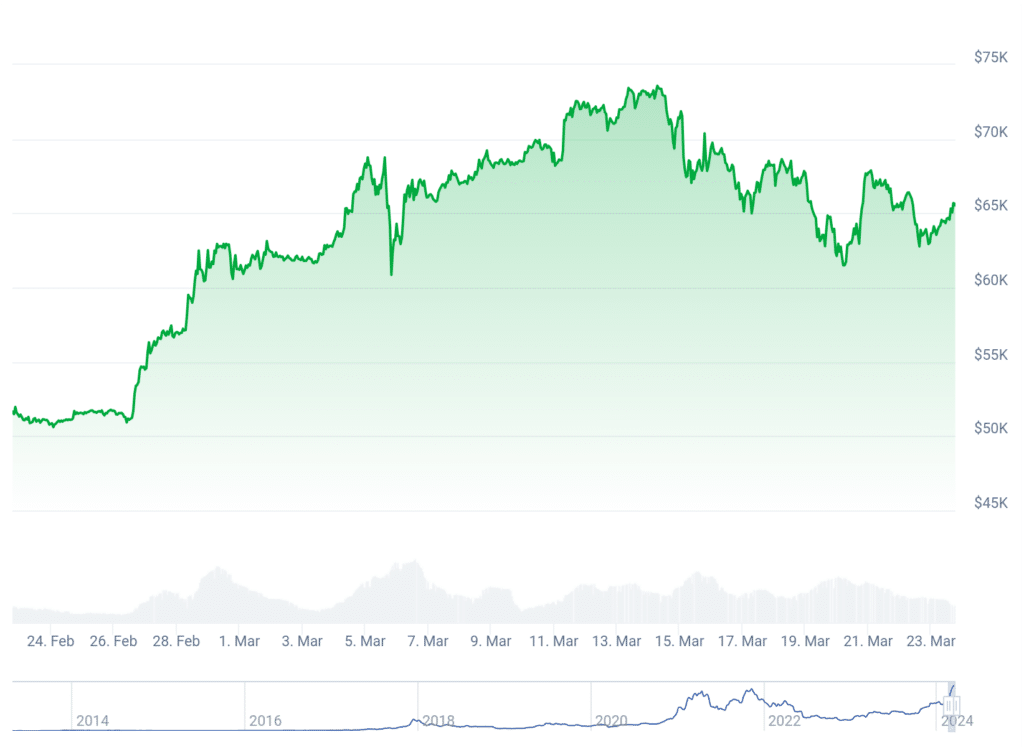

Bitcoin has experienced nearly a 2.6% price drop over the past week and 4% in the last fortnight. According to Van de Poppe, this could be due to the upcoming halving event.

He said that like every other cycle, we are yet to see Bitcoin peak before the halving, adding that we might not see much “spectacle” coming from Bitcoin unless it hits $70,300.

Bitcoin halving is an automatic process that reduces miner rewards by half. Halving occurs every four years, or after 210,000 blocks of Bitcoin are mined. The next halving event is expected to take place in April 2024.

Van de Poppe compared Bitcoin’s price action to the 2016–2017 cycle, suggesting that history will repeat itself and Bitcoin will experience a significant upward trend.

“My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.”

At the time of writing, Bitcoin was trading at $65,537, a 3.2% increase in the last 24 hours, according to CoinGecko. As previously stated, the current price represents a 2.6% drop over seven days.

However, it marks a 26% improvement over 30 days.

Pseudonymous analyst Rekt Capital suggests that this year’s Bitcoin pre-halving correction has already begun. Bitcoin pre-halving retraces typically occur 14–28 days before the halving event.

According to Rekt Capital, this year’s price fall is similar to the 20% pre-halving correction in 2020 and the 40% pullback before the 2016 halving.

He added that the correction would last about 77 days, though the reduction could be less than in previous cycles.

The current downward trend presents a better opportunity for investors to buy Bitcoin before the upcoming halving event, which, if history repeats itself, will likely be followed by a bullish trend.

This article first appeared at crypto.news