Share this article

Bitcoin’s prolonged period of price consolidation could be setting the stage for a robust bull market, according to technical analyst Rekt Capital.

“The fact that Bitcoin is struggling to break out is beneficial for the overall cycle,” Rekt Capital explained in a recent post on X.

“This continued consolidation is enabling price to resynchronize with historical [halving] cycles so that we can get a normal, usual [bull run],” he added.

Rekt Capital suggested that current market behavior is in line with historical halving cycles. He also noted that Bitcoin’s struggle to break out early post-halving is typical and prevents an accelerated cycle that would result in a shorter bull market.

In a separate post, he pointed out that Bitcoin has entered the re-accumulation phase, with consolidation potentially extending for another three months based on past patterns.

“It shouldn’t be surprising therefore if price rejects from the range high resistance,” stated Rekt Capital.

Despite reaching a new high of $73,000 in mid-March before the halving, Bitcoin has not seen a significant rally since. According to Crypto Quant, the fact that Bitcoin has yet to see a major price rally could be linked to the slowdown in USDT’s market capitalization.

Final puzzles

With Bitcoin halving and the spot Bitcoin ETF decision behind us, the US presidential election and macroeconomic factors are seen as potential positive catalysts for Bitcoin.

The upcoming US presidential election in November has brought crypto to the forefront of some political discussions. Standard Chartered suggests that a potential return of Donald Trump to office could positively impact the value of Bitcoin. The bank also believes a Trump victory could benefit the overall US crypto landscape.

Another factor that could benefit the Bitcoin market is the Federal Reserve’s (Fed) timeline for interest rate cuts. The future rate cuts are expected to bring increased liquidity to markets, potentially benefiting Bitcoin and other crypto assets.

The Fed held rates steady at its June FOMC meeting. Fed Chair Powell, citing continued high inflation, indicated a cautious approach with the potential for one cut this year and four in 2025.

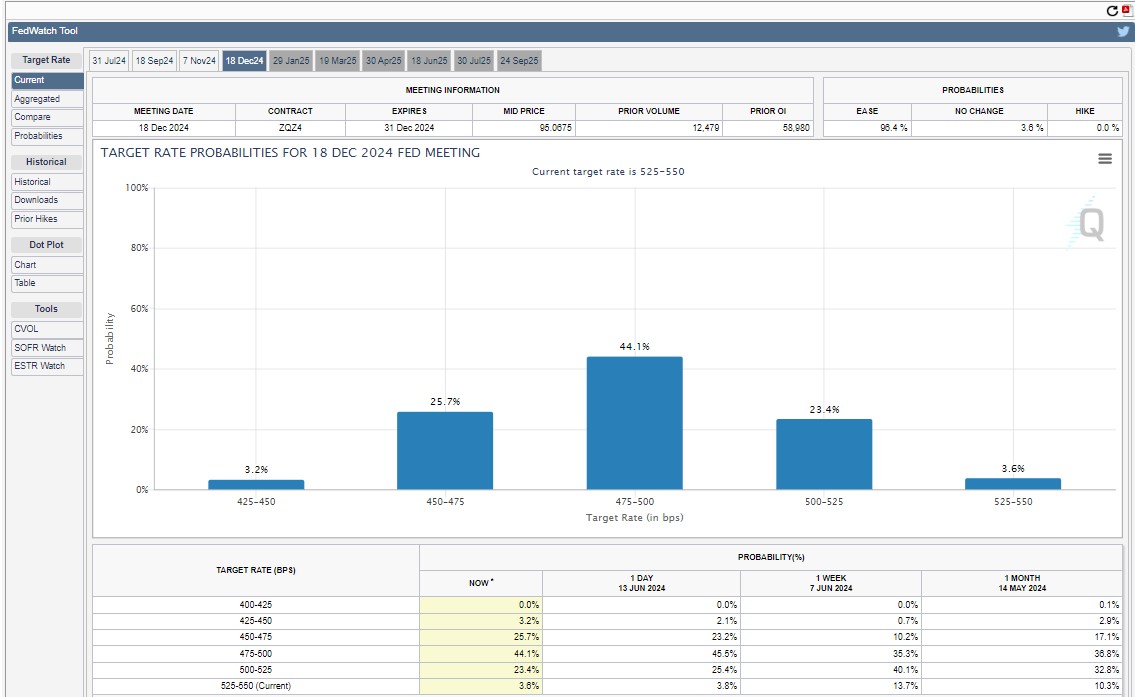

CME FedWatch Tool suggests a near certainty of a rate cut expected in December, rising from around 85% last week to nearly 97%.

Bitcoin surged on Wednesday after cooler-than-expected inflation data. May’s CPI showed inflation at 3.3% year-over-year, beating estimates of 3.4%. Core inflation also came in lower at 3.4%, compared to the predicted 3.5%.

However, the bullish momentum was short-lived. Briefly after inching closer to $70,000, BTC dipped to $67,500 on Wednesday and extended its correction on Thursday, hitting as low as $66,400, according to data from CoinGecko.

At the time of writing, BTC is trading at around $66,800, down 6% over the last seven days.

Share this article

This article first appeared at Crypto Briefing