As Bitcoin struggles to quickly recover above $60,000, miners are facing profitability issues across the industry.

Bitcoin’s (BTC) temporary crash below $50,000 on Monday, Aug. 5, has put many crypto miners in a challenging situation as they are now facing profitability issues across the whole industry, analysts at Hashrate Index say.

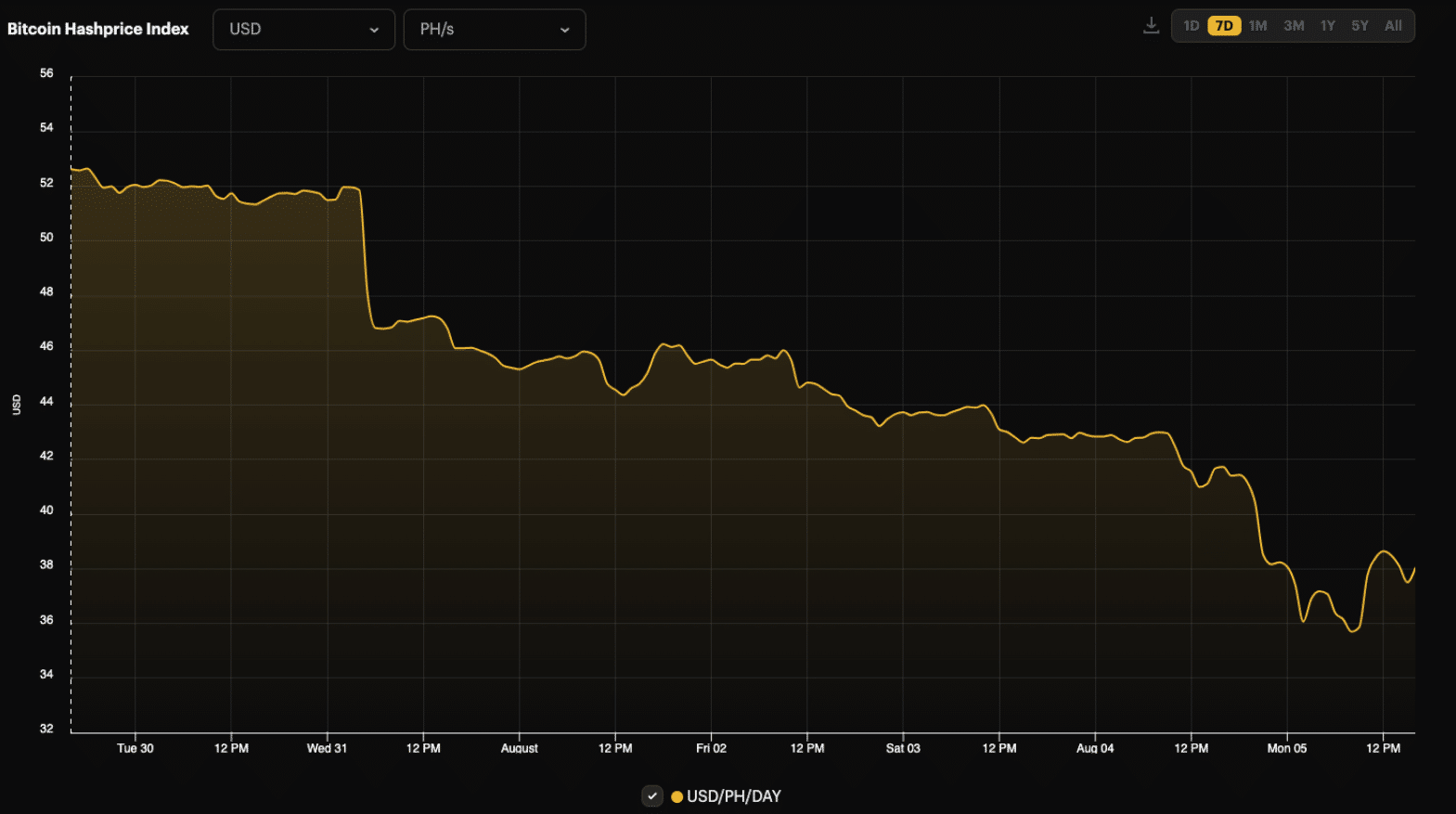

In a blog post, Hashrate Index’s analyst Kaan Farahani highlighted that Bitcoin’s drop to $55,000 caused a significant decline in the hashprice metric, which fell by 28% on a weekly basis, putting “stress on miner profitability.”

Despite the bearish price movements, Farahani noted that Bitcoin’s global network hashrate remained “relatively steady throughout the week,” with the 7-day simple moving average network hashrate decreasing only by approximately 1%, from 644 EH/s to 638 EH/s.

“This modest reaction may signal a turn towards lower seasonal hashrate volatility in the coming weeks to months, as energy curtailment programs for hot summer months are expected to calm down.”

Kaan Farahani

The slight decline in hashrate led to an average block time of around 10 minutes and 12 seconds throughout the week, with analysts at Hashrate Index predicting a “slight decrease” in mining difficulty of around 2% for the upcoming adjustment on Aug. 14.

Bitcoin can still go lower

As Bitcoin struggles to break above $56,000, some analysts do not rule out further declines. Despite a rebound from $49,000, CryptoQuant analysts warn that breaking below the $57,000 support level could lead to a “possible drop to $40,000,” leaving investors uncertain about Bitcoin’s next move.

A further decline in Bitcoin’s price could exacerbate the pressure on shares of crypto mining companies, which have already seen significant drops amid market chaos in Asia. Data from Hashrate Index shows that among 12 publicly traded Bitcoin mining companies, the average decline over the past week was 21%. Bitdeer experienced the largest drop at 28.59%, while Iris Energy managed to limit its losses to a 12.31% decline.

This article first appeared at crypto.news