Bitcoin ATMs are popping up worldwide, with their numbers jumping 6% in 2024, showing how crypto is becoming more mainstream.

The number of Bitcoin ATMs keeps growing, making it easier for people to buy and sell cryptocurrencies. Recent reports show this trend is continuing. Just like regular ATMs, Bitcoin ATMs let you add cash to your crypto wallet, so the process is quick and simple.

So, what exactly are Bitcoin ATMs? These machines work like regular ATMs but are made for cryptocurrencies. Bitcoin (BTC) and sometimes other tokens can be bought using cash or a bank card. Some machines even allow selling crypto for cash, though the fees are usually higher than when buying.

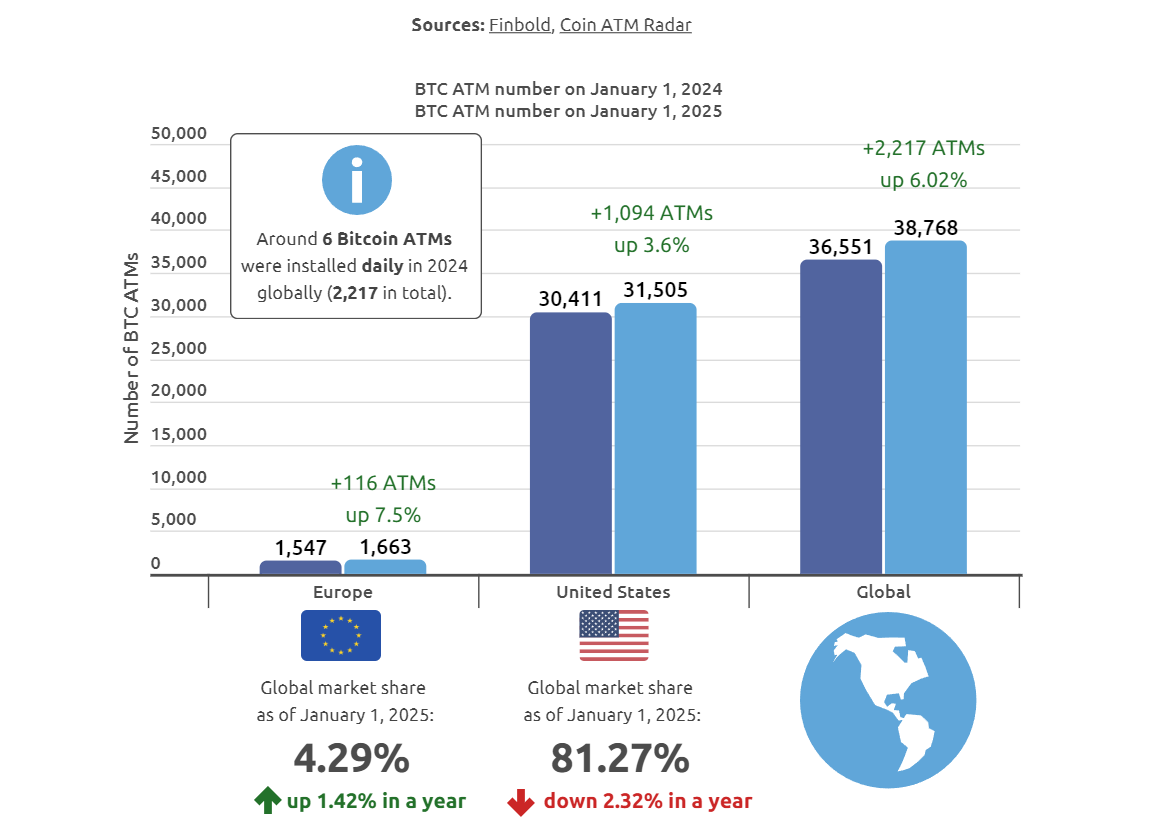

The first Bitcoin ATM appeared in Vancouver, Canada, in 2013. It was a big moment for making crypto more accessible to the public. Since then, Bitcoin ATMs have grown rapidly, with over 37,500 machines in more than 70 countries. According to the latest research by Finbold, which cites data from Coin ATM Radar, 2024 was a standout year, with a 6% increase in the number of Bitcoin ATMs.

Bitcoin ATMs mainly landed in US

The U.S. is still the leader in Bitcoin ATMs, holding over 81% of the global market share. As of Jan. 13, there were more than 31,500 Bitcoin ATMs in the U.S., a gain of over 1,000 machines compared to the start of 2024. The global total hit 38,768, bouncing back from a dip in mid-2023 when the number dropped to around 33,000.

Europe has a smaller but growing presence in the Bitcoin ATM market. Although it’s not as big as the U.S., Europe’s number of ATMs has been steadily rising, even during crypto downturns, the report reads. In 2024, the region added 116 new machines, a 7.5% increase from 2023. This steady growth is unique, as many other regions saw declines during the crypto winter, the report notes.

Most of the ATM growth in 2024 happened in the first half of the year. By late April, 1,942 new machines were installed globally, averaging 485 machines a month between January and April. However, growth slowed down in the second half, with only 34 machines added per month between May and December. The slowdown came even though Bitcoin hit new all-time highs in November when its price neared $100,000.

Diverse regulatory approaches

In most places, Bitcoin ATMs are legal, though regulations vary. For example, in the U.S., they are regulated by the Financial Crimes Enforcement Network. Operators must register as money services businesses and follow AML and KYC rules for larger transactions. At the state level, operators often need a money transmitter license and must follow consumer protection laws like fee transparency and data security. Local zoning laws can also impact how crypto ATMs function.

Internationally, regulations around crypto ATMs vary by country, with the U.K.’s Financial Conduct Authority stepping up its oversight. In September 2024, crypto.news reported that London-based Olumide Osunkoya pleaded guilty to five offenses for running an illegal network of crypto ATMs across the U.K. This marked the country’s first conviction of its kind.

Earlier that year, in August, German authorities confiscated 13 crypto ATMs and seized nearly $28 million in cash from 35 locations across the country. The operation, led by BaFin, targeted machines operating without proper licenses, raising concerns about money laundering.

Bitcoin ATM scams surge, with older adults most affected

While most Bitcoin ATMs are run by legitimate companies, regulators are concerned they could be used for fraud or money laundering. New data from the Federal Trade Commission shows a huge rise in the amount of money consumers report losing to scams involving Bitcoin ATMs. Since 2020, the reported losses have nearly increased tenfold, reaching over $110 million in 2023.

The Federal Trade Commission also found that fraud losses linked to Bitcoin ATMs topped $65 million in the first half of 2024. People aged 60 and older were more than three times as likely to lose money to Bitcoin ATM scams compared to younger adults. Across all age groups, the median loss was an eye-watering $10,000. Most of the scams involved government impersonation, business impersonation, and tech support scams, the FTC said.

This article first appeared at crypto.news