The depth of the Bitcoin market reached a record $600 million, coinciding with Bitcoin’s recent all-time high.

Experts added that this situation indicates traders are taking profits as the historical maximum is renewed.

On March 4, open interest in Bitcoin (BTC) perpetual contracts jumped nearly $2 billion to a multi-year high of $15 billion before falling $1.4 billion the next day. Experts concluded that the preservation of financing rates near the peaks indicates the stability of demand for the asset.

However, on-chain analysis showed a relatively slow increase in new Bitcoin millionaires. During the current rally, the daily increase in the holders of the seven-digit dollar bar remained below 2,000. For comparison, in 2021, these rates reached 4,000 wallets for an eight-digit value—2,000 addresses.

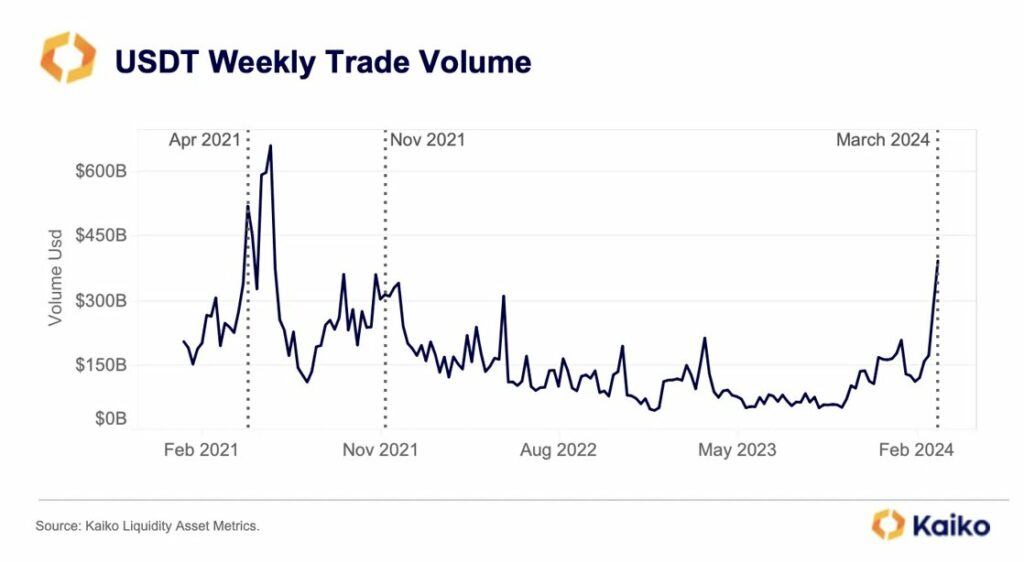

Kaiko also drew attention to USDT’s achievement of a record $100 billion capitalization. The peaks did not increase trading activity – turnover remained well below the peak of $661 billion in May 2021, and the share of total volume decreased.

Today, Bitcoin tested the $73,000 mark but rolled back to below $72,000, marking the third price jump in the last two days. On March 11, the asset hit its ATH twice, reaching $72,200.

The volume of liquidations on futures contracts over the past 24 hours exceeds $233 million.

This article first appeared at crypto.news