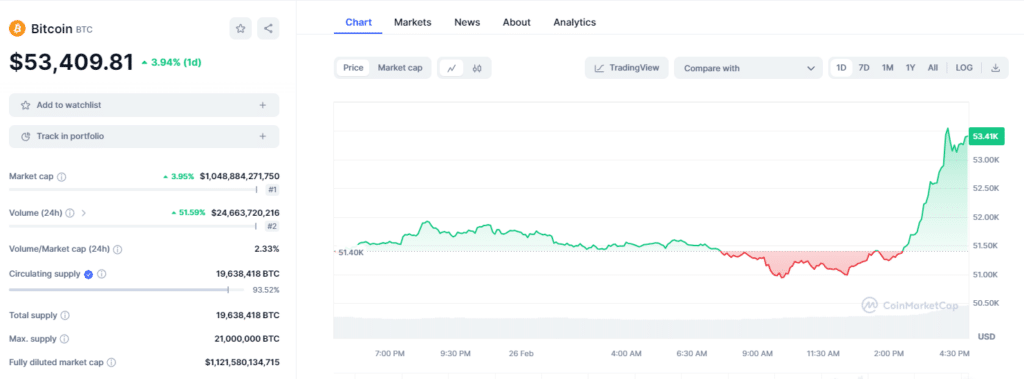

Bitcoin’s value soared to its highest point over two years, surpassing the $53,000 mark.

The leading digital currency experienced an upswing of up to 3.3%, reaching $53,456, a price point not seen since December 2021. According to CoinMarketCap, BTC trading volume has surged over 50% today.

The uptick occurred in the wake of reports that MicroStrategy, under the leadership of Michael Saylor, expanded its Bitcoin portfolio by purchasing an additional 3,000 units at a total cost of $155.4 million. MicroStrategy’s total Bitcoin investment is now valued at nearly $10 billion. The acquisition price averaged $51,813 per Bitcoin, with their holdings’ overall average purchase price at $31,544.

Over the recent weekend, analysts pointed out that Bitcoin may enter the third phase of a pattern that historically precedes significant price rallies. It is noted that Bitcoin’s price typically benefits during periods of increased global liquidity – the vast sums of money circulating within the global financial ecosystem.

Despite a current downturn in global liquidity, Bitcoin’s price is on the rise, leading analysts to speculate that its value could surge beyond expectations should global liquidity levels rebound.

With this latest rally, Bitcoin gained nearly 30% in February. Given the positive sentiment across the wider market, as April’s halving is getting closer, Bitcoin’s bull run might enter a new phase. BTC’s fear and greed index has now entered 72 (greed), a massive 20 points since the start of this year.

This article first appeared at crypto.news