Banana Gun token price continued its strong rebound on Aug. 17 even as other cryptocurrencies like Bitcoin and Ether retreated.

The banana token rally accelerates

The Banana (BANANA) token rose for the second consecutive day, reaching a high of $64.47, its highest level since July 26 and 117% above its lowest level in August. The other top-performing tokens were Neiro (NEIRO) and Synapse (SYN), which rose by over 105% and 40%.

Banana Gun’s jump pushed its market cap to over $205 million. It happened in a high-volume environment as the 24-hour volume jumped to over $271 million.

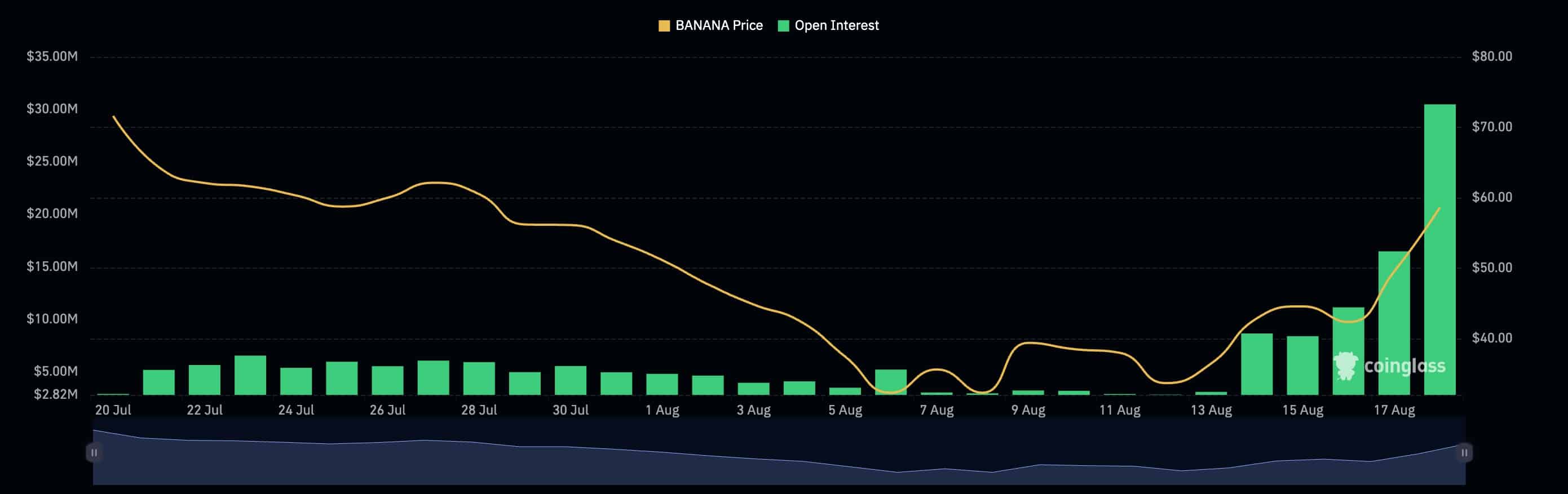

Additional data shows that Banana’s demand also jumped in the futures market as the open interest rose to a record high of $30.50 million. It had an open interest of $16.50 million on Friday and $11 million on Thursday, according to CoinGlass.

A likely reason for the surge is that Birdeye, an on-chain data aggregator, announced that Banana’s Solana (SOL) bot was available on its ecosystem. The integration means that users can access Banana’s transactions easily and it came a few days after the Solana Reborn launch.

Additionally, some crypto traders pointed to Banana’s fundamentals for the rally. Data by Dune Analytics shows that the Telegram bot has had over 237,000 lifetime users, 4,745 daily active users, and has handled over $5.8 billion worth of transactions in its lifetime.

Additionally, the developers have continued to reduce the number of Banana tokens in circulation. Most recently, they burned 2% of the total supply, a move that is aimed at creating value for the tokens in circulation.

Technicals point to more Banana Gun upside

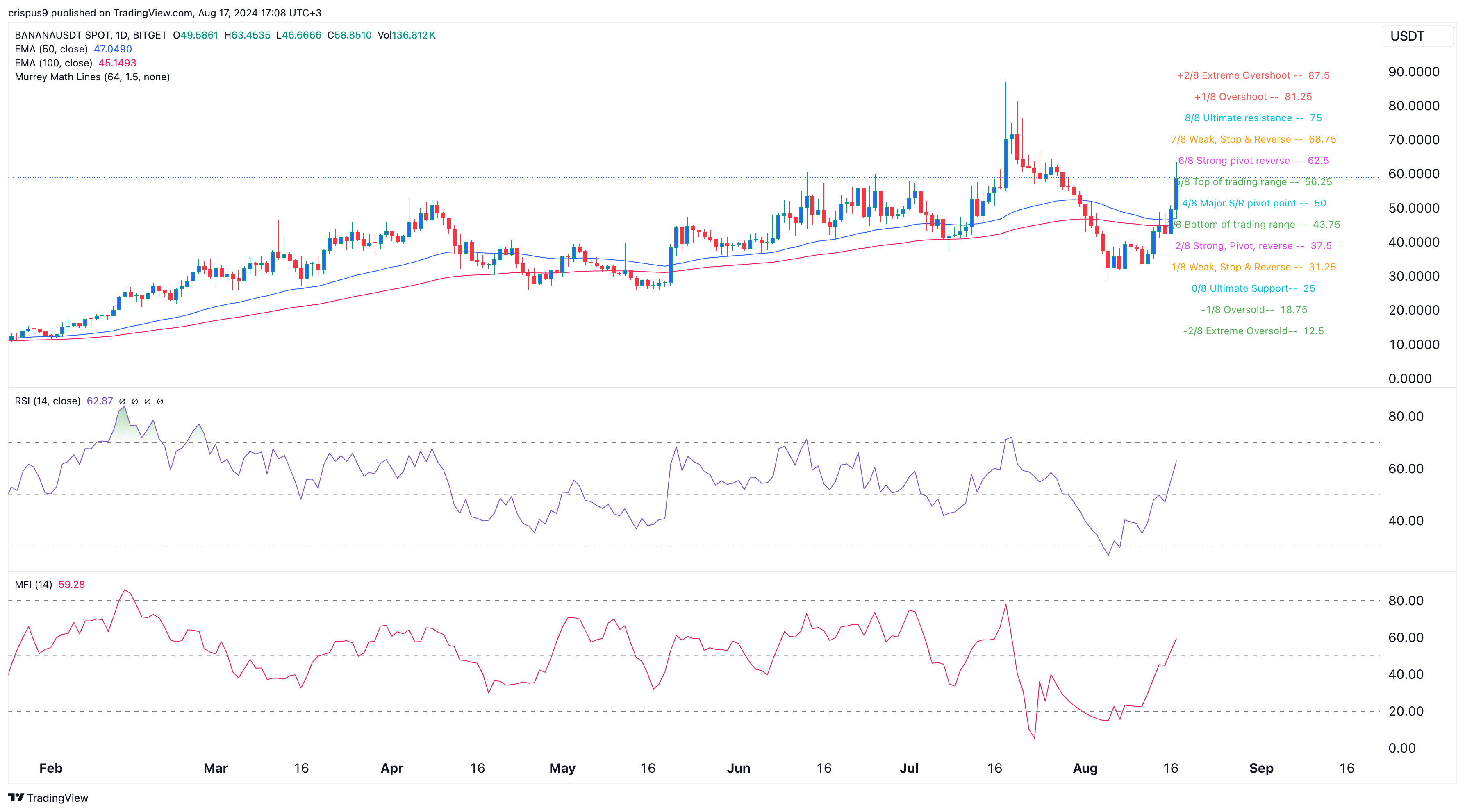

Meanwhile, technicals show that the Banana token may have more upside before retreating. It has already crossed the 50-day and 100-day Exponential Moving Averages, meaning that bulls are in control for now.

At the same time, the Relative Strength Index and the Money Flow Index have crossed the neutral point at 50, meaning that it is not yet overbought. The Murrey Math Lines show that it has more room to run before getting to its ultimate resistance level.

Therefore, the Banana Gun token may continue rising as buyers target the resistance at $75. As with other similar parabolic moves, the token will then retreat as investors start to take profits.

Banana Gun launched in early 2023 at around $10.

This article first appeared at crypto.news