Sui has seen a market cap rebound of over 10% in the past 24 hours as a result of its growing presence in DeFi and gaming sectors.

According to on-chain analytics platform Santiment, Sui’s market cap growth is supported by new partnerships, staking rewards, and an increasingly bullish social media sentiment, which is at its highest since September.

Sui’s price has surged an impressive 259% over the past five months. Santiment warns that rising FOMO could derail long-term price growth as pushing the token’s price up too quickly could lead to large retracements.

The market capitalization of stablecoins on Sui, which hit a record high of $500 million as per DefiLlama data, further contributes to the recent market recovery. Rising stablecoin inflows mean fresh liquidity is entering the Sui network. This is a sign of increased interest and activity on the platform.

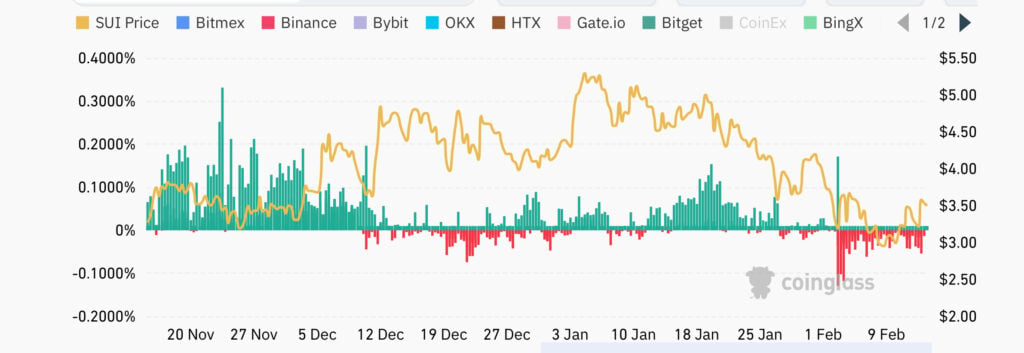

Other signals show that Sui is gaining strength in the derivatives market as well. For the first time in over a week, the funding rate for SUI turned positive. The total value of open interest contracts has reached $451.3 million. These signals suggest traders are becoming more optimistic, which could mean Sui’s price might keep rising if the trend continues.

Sui has positioned itself as a blockchain that combines the benefits of web3 with the ease of web2. The network’s low fees and fast transactions have drawn the attention from DeFi projects and the gaming sector, which continue to expand on the network. Sui has also inked partnerships with institutional players such as Franklin Templeton, Grayscale, Libre Capital, and Copper.

It’s unclear if market pressures will subside in the upcoming weeks or if SUI will sustain the momentum in the long-term.

This article first appeared at crypto.news