Altcoins dogwifhat, Bonk, THORChain, and Jupiter have suffered losses above 10% as Bitcoin dipped 4% in the last 24 hours.

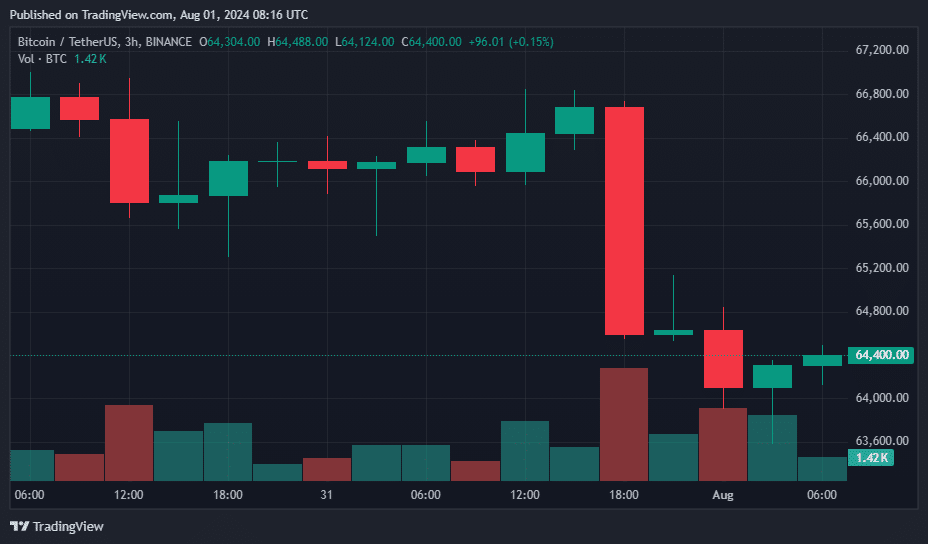

Following a period of relative calm yesterday, July 31, Bitcoin’s (BTC) price actions experienced a dramatic shift as the cryptocurrency fell by more than $3,500, bringing its value down to $63,300. At the same time, altcoins also mirrored this trend, with the total value of liquidated positions soaring to nearly $225 million over the course of the day.

Initially, the week started on a high note for Bitcoin, as it climbed to its highest point since early June, reaching $70,000. However, this peak was short-lived as a swift rejection ensued, leading to a substantial decline, with Bitcoin dipping below the $65,500 mark.

The cryptocurrency did manage to regain some stability, trading quietly at about $66,800. Nonetheless, following a press conference by Federal Reserve Chair Jerome Powell, Bitcoin’s value tumbled again to $64,300, marking a decrease of over 3% within 24 hours.

The downturn coincided with a report from the New York Times stating that Iran had called for retaliatory measures against Israel following the assassination of Hamas leader Ismail Haniyeh in Tehran, escalating the potential for further regional conflict.

Meanwhile, on the economic front, the Federal Reserve decided to maintain the benchmark interest rates, offering little insight into the anticipated rate cut in September. Powell also hinted that while no concrete decisions were made regarding the September adjustment, there is a growing consensus on the likelihood of a reduction.

Amid the Bitcoin drop, altcoins have suffered even more significant losses. For instance, dogwifhat (WIF) saw a 12.4% decrease, and (BONK) experienced a 10% decline. Other altcoins like THORChain (RUNE) also fell by 10%, while Jupiter (JUP) and Ethereum Name Service (ENS) decreased by 8% and 9%, respectively.

Among the larger-cap cryptocurrencies, the biggest losers are Solana (SOL) with an 8% drop, (XRP) down 6%, Cardano (ADA) falling 4%, and both Ethereum (ETH) and Dogecoin (DOGE) experiencing a decline of 4.4%.

Data from CoinGlass indicates that nearly 67,000 traders have been adversely affected by this increased volatility. BTC positions have seen $61.85 million in liquidations, while ETH positions have faced $61 million. In total, the value of liquidated positions stands at $225.4 million at the time of writing.

This article first appeared at crypto.news