AI tokens FET, AGIX, and OCEAN have witnessed significant gains over the past 24 hours, amidst trending discussions around the creation of a new ‘Artificial Superintelligence’ (ASI) token.

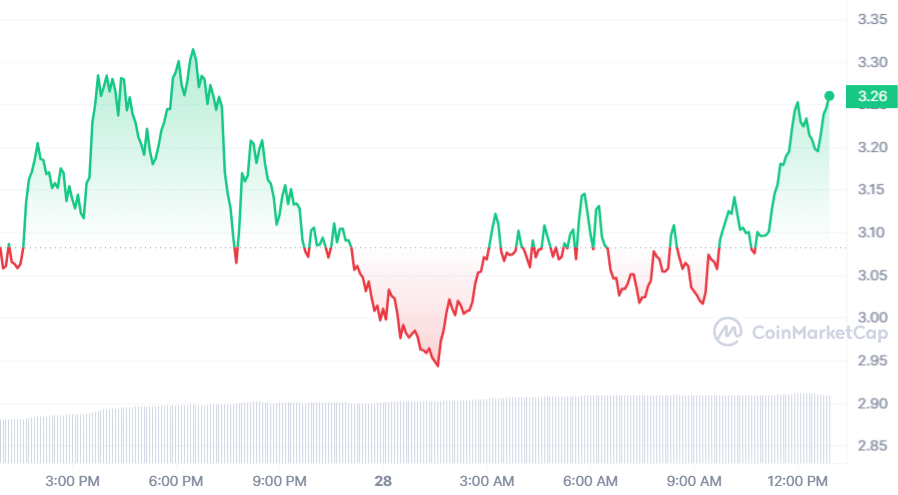

Fetch.ai’s FET token has observed a 6% rise, with its trading price at $3.26 and a 24-hour trading volume surging by 57% to approximately $1.1 billion. Its market capitalization now stands at $2.73 billion, showcasing a strong investor interest.

SingularityNET’s AGIX token has also seen a significant upturn, trading at $3.26, marking a 10% increase within the same period. The trading volume for AGIX has skyrocketed by 150%, reaching about $554 million, while its market cap has expanded to $1.7 billion.

Among these, the OCEAN token of Ocean Protocol has made the most remarkable gains, jumping by 18%. Its trading volume has exploded by 900%, amounting to around $640 million, with a total market cap of $820 million.

This price movement indicates growing optimism among investors about the potential merger of these AI-focused projects.

The surge in value comes ahead of a scheduled community vote on April 2 for a proposed token merger involving SingularityNet, Fetch.ai, and Ocean Protocol, with a combined market capitalization of approximately $5.3 billion.

If approved, this merger would lead to the creation of the Artificial Superintelligence Alliance’s ASI token, aiming to consolidate the strengths of the three entities into a unified force capable of competing against Big Tech’s dominance in AI.

The alliance, set to be known as the Superintelligence Collective, aspires to merge Fetch.ai’s decentralized AI application platform, SingularityNET’s AI services marketplace, and Ocean Protocol’s data exchange framework.

The initiative is a response to the exponential growth of AI projects and aims to provide a decentralized alternative for AI development, use, and monetization, challenging giants like OpenAI, Google, and Microsoft.

Under the merger terms, a total of 2.631 billion ASI tokens will be distributed, replacing the existing AGIX, FET, and OCEAN tokens, which would then be convertible into ASI at predetermined rates.

The merger details include a one-to-one swap rate for FET into ASI tokens, and additional ASI tokens will be minted to allocate 867 million to AGIX holders and 611 million to OCEAN tokenholders, translating to fixed conversion rates for these tokens into ASI.

Token holders storing their AGIX and OCEAN tokens on exchanges need not take any action, as the conversion to ASI tokens will be handled directly by the exchanges.

The strategic move is supported by on-chain data and market sentiment analyses indicating a positive outlook for the merger, with a significant increase in the combined market cap of the category to $43.12 billion observed.

This article first appeared at crypto.news