A major Aave contributor has submitted a plan to upgrade the protocol’s tokenomics following a successful temperature check last August.

Marc Zeller, founder of the Aave (AAVE) Chan Initiative, has formally requested for community support on a proposal to restructure the project’s revenue allocation, sunset the LEND smart contract, and implement improvement liquidity management systems for users.

Zeller’s ACI is a prominent delegate in the Aave DAO, the decentralized autonomous organization tasked with bettering the largest on-chain lender.

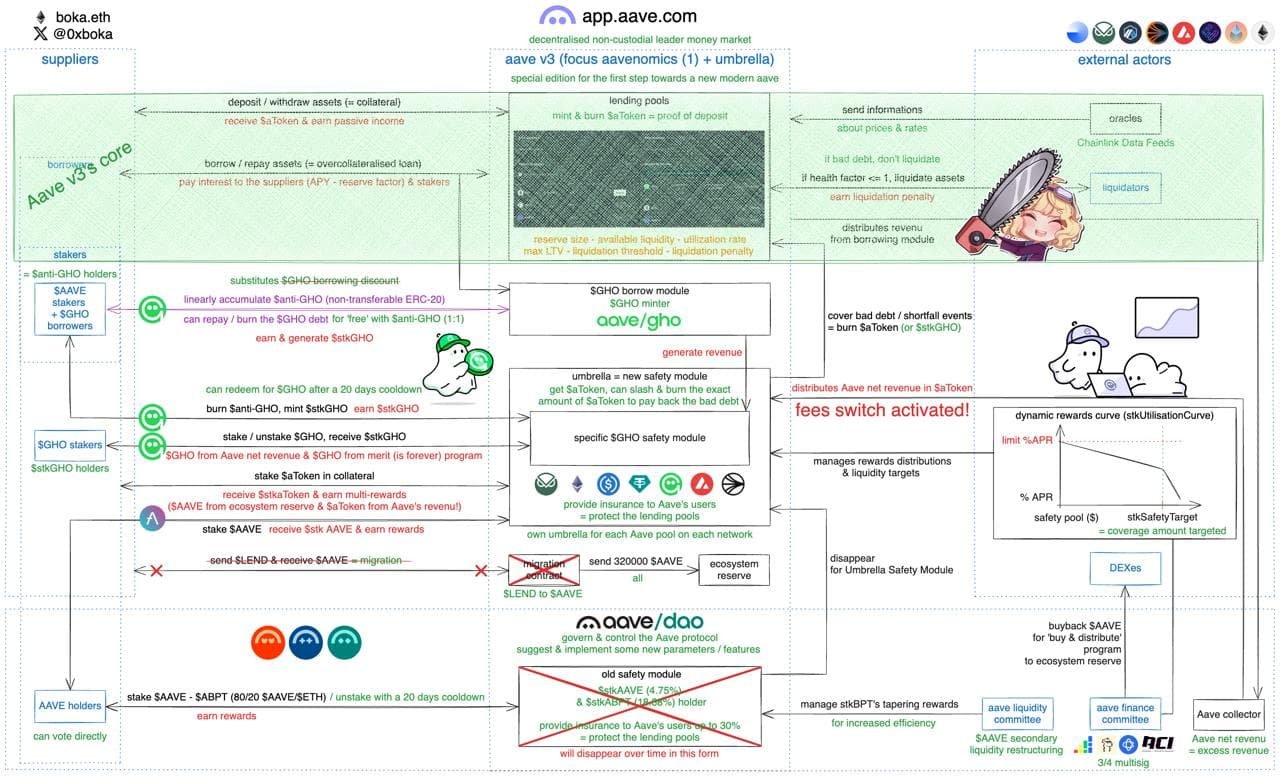

The ACI’s Aave Request for Comment would implement phase one of the so-called “Aavenomics” plan. Under the strategy, the project would create an Aave Finance Committee to manage its $115 million treasury and enable a fee switch to reward important players.

Part of the AFC’s mandate would include a six-month AAVE token buyback with a $1 million weekly budget. The DAO would reassess the program after its completion, and decide to either upscale or tighten the strategy, per Zeller’s proposal.

The ACI also proposed freezing the LEND migration contract to recover 320,000 AAVE coins. LEND was the DeFi lender’s initial governance token before the 2020 upgrade to AAVE. About $65 million worth of tokens currently sits in LEND’s smart contract.

As the top on-chain protocol for borrowing and lending crypto, Aave spends a small fortune financing liquidity costs. The ACI intends to trim this $27 million annual bill by merging staking and liquidity management under a new “Umbrella” safety system.

The proposal also suggested creating Anti-GHO, a revenue distribution module for the GHO stablecoin to reward AAVE stakers. Zeller called the plan the ACI “most important proposal” so far. The ARFC was released six months after an approved temperature check back in August.

This article first appeared at crypto.news