The Bitcoin outflows from centralized exchanges and the rising whale accumulation helped it surpass the $67,000 mark again.

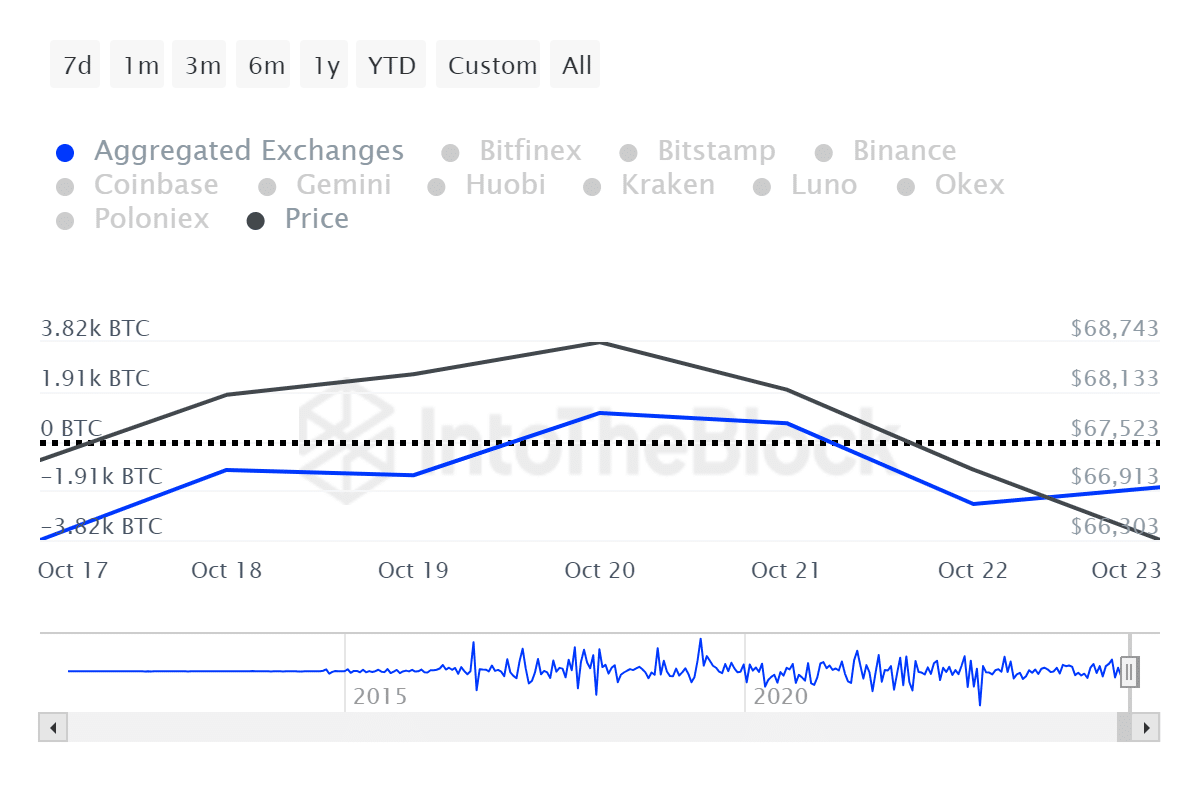

According to data provided by IntoTheBlock, the Bitcoin (BTC) exchange net flows witnessed two days of inflows on Oct. 20 and 21, bringing the price down from the local high of $69,400.

On Oct. 22 and 23, this movement shifted back to outflows. Per ITB data, BTC recorded a net outflow of $581 million over the past week. The increased outflows show the accumulation phase.

Whales join the accumulation

Whales also started selling Bitcoin on Oct. 21 as 94% of the holders were in profit. Data shows that the selloff among large holders is also fading away.

Bitcoin whale addresses recorded a net inflow of 165.5 BTC, worth $11.15 million, yesterday.

Notably, the total amount of Bitcoin whale transactions, consisting of at least $100,000 worth of BTC, surpassed the $100 billion mark over the past week.

High whale activity and accumulation could trigger a market-wide FOMO.

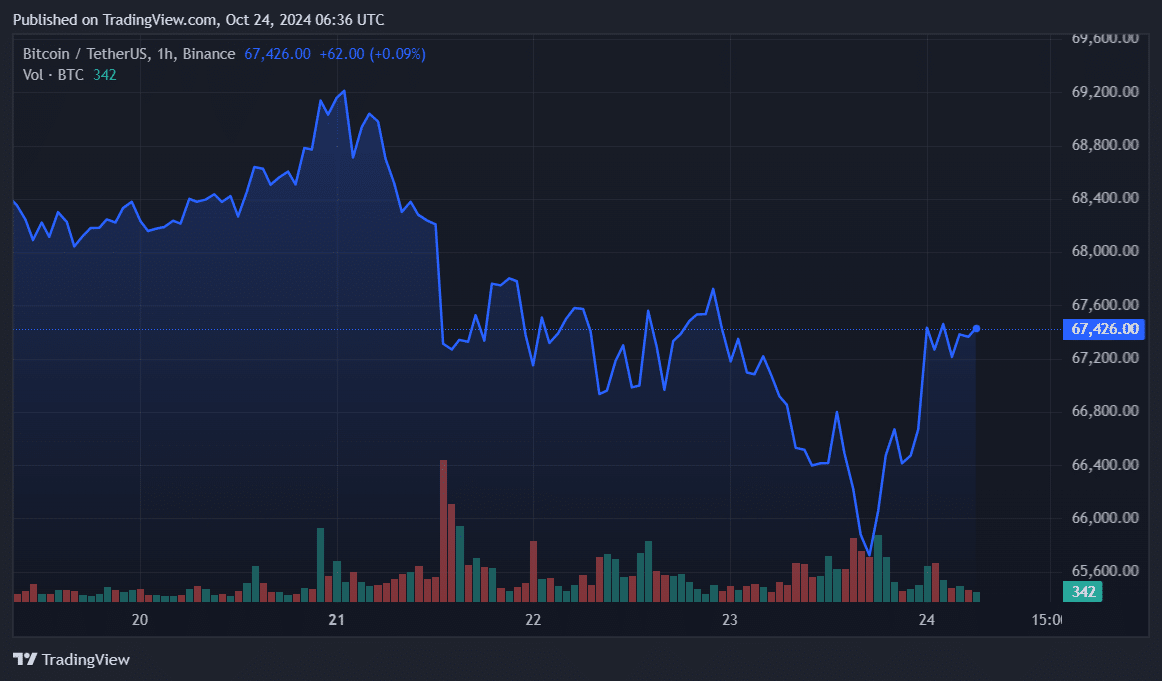

Bitcoin is up 0.3% in the past 24 hours and is trading at $67,350 at the time of writing. The asset’s market cap is sitting at $1.33 trillion with an 18% rise in its daily trading volume, reaching $35 billion.

Another bullish catalyst on Wednesday was the increased spot BTC exchange-traded funds’ inflows in the U.S. According to a crypto.news report, these investment products saw a net inflow of $192.4 million on Oct. 23, led by BlackRock’s iShares Bitcoin Trust ETF.

This article first appeared at crypto.news